The stock market has maintained a bullish trend for some time, rebounding from earlier losses experienced at the beginning of the month. This upward momentum is largely driven by strong economic data, which has bolstered investor confidence in potential interest rate cuts and favorable macroeconomic policies.

Against this backdrop, investors are paying close attention to this week’s earnings reports, with Nvidia (NVDA) in the spotlight. The tech giant is set to release its financial results, along with other key players in the tech sector, which could further influence market sentiment.

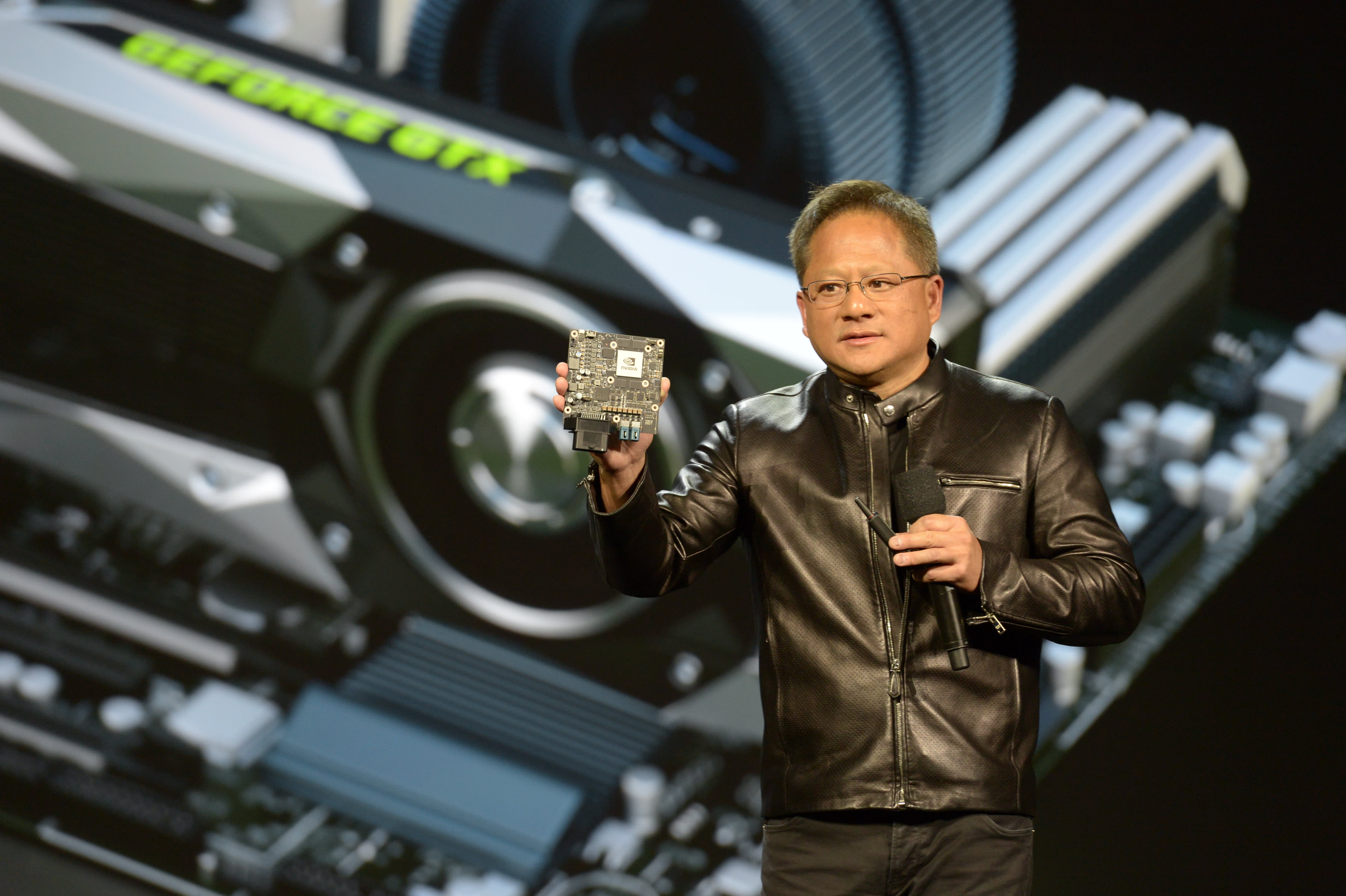

Nvidia Earnings: A Major Market Mover

Nvidia’s (NVDA) earnings report on Wednesday highlights a busy week for corporate finances, with Salesforce (CRM), Dell (DELL), HP (HPQ) and CrowdStrike (CRWD) among the other tech firms set to report. Retailers like Dollar General (DG), Five Below (FIVE), Abercrombie & Fitch (ANF) and Ulta Beauty (ULTA) are also on tap.

Nvidia’s earnings come after its prior quarter report showed the company more than tripled its revenue and grew its net income more than six-fold, with both totals coming in above analyst estimates. The report comes as Goldman Sachs recently classified Nvidia as the "most important stock" of the year.

Salesforce, CrowdStrike, and the AI Landscape

Salesforce’s report on Wednesday will show whether demand for its artificial intelligence (AI) products can continue to drive the company’s revenue higher. Cybersecurity provider CrowdStrike will report for the first time since it issued a software update contributing to a global computer network outage.

Investors will also get a look at how AI is affecting computer sales, with HP reporting on Wednesday and Dell issuing earnings on Thursday.

Retail Earnings and Consumer Sentiment

Retail reports continue this week, with several discount chains issuing reports, including Dollar General, which has reported increasing same-store sales. At the same time, Five Below is also set to release quarterly financials. Ulta Beauty’s report comes after filings showed that investor Warren Buffett’s Berkshire Hathaway bought shares in the makeup seller.

Inflation and GDP Data: Clues for the Fed

The Friday release of the Personal Consumption Expenditures (PCE) will show whether inflation continued to drop in July, potentially signaling the Federal Reserve’s next move. Second-quarter Gross Domestic Product (GDP) is published Thursday, while investors will also be watching housing market data and consumer sentiment surveys.

The Personal Consumption Expenditures (PCE) index is the Fed’s preferred measure of price changes, and a further decline in the July reading could show that inflation is moving back toward the central bank's annual target of 2%.

On Thursday, market watchers will get another look at second-quarter Gross Domestic Product (GDP) after the first reading showed accelerating growth of 2.8%.

Other Key Economic Indicators

For more insights into what’s expected this week, read below:

Tuesday

The S&P Case-Shiller Home Price Index, which monitors home prices across 20 major U.S. cities, is coming Tuesday, alongside the latest Consumer Confidence report. Later in the week, Thursday will bring the release of initial jobless claims data, as well as the second estimate of GDP for the second quarter. This revised GDP estimate incorporates more comprehensive source data, providing a clearer picture of economic growth during the period.

Wednesday

Thursday

Beyond Earnings: SpaceX Mission and Fintech Conference

SpaceX is attempting to achieve another milestone with the upcoming Polaris Dawn mission. The launch window for Polaris Dawn is scheduled between 3:30 a.m. and 7 a.m. on Tuesday, as stated by the Kennedy Space Center.

This commercial spaceflight program is designed to push the boundaries of private space travel and exploration, according to the Polaris Dawn website. This mission aims to advance commercial spaceflight capabilities, further solidifying SpaceX’s role as a leader in the space industry.

Moreover, the annual Fintech South conference is scheduled for Tuesday and Wednesday at the Woodruff Arts Center in Atlanta, Georgia. The conference tagline — “Fintech Lives Here!” — underscores Atlanta’s role in the world of financial technology. For more on the agenda, you can find additional information here.

With a busy week ahead, market participants are eagerly anticipating the release of key economic data and corporate earnings reports. These insights will provide valuable information about the health of the economy and the direction of corporate profits, ultimately shaping the trajectory of the stock market in the coming weeks.