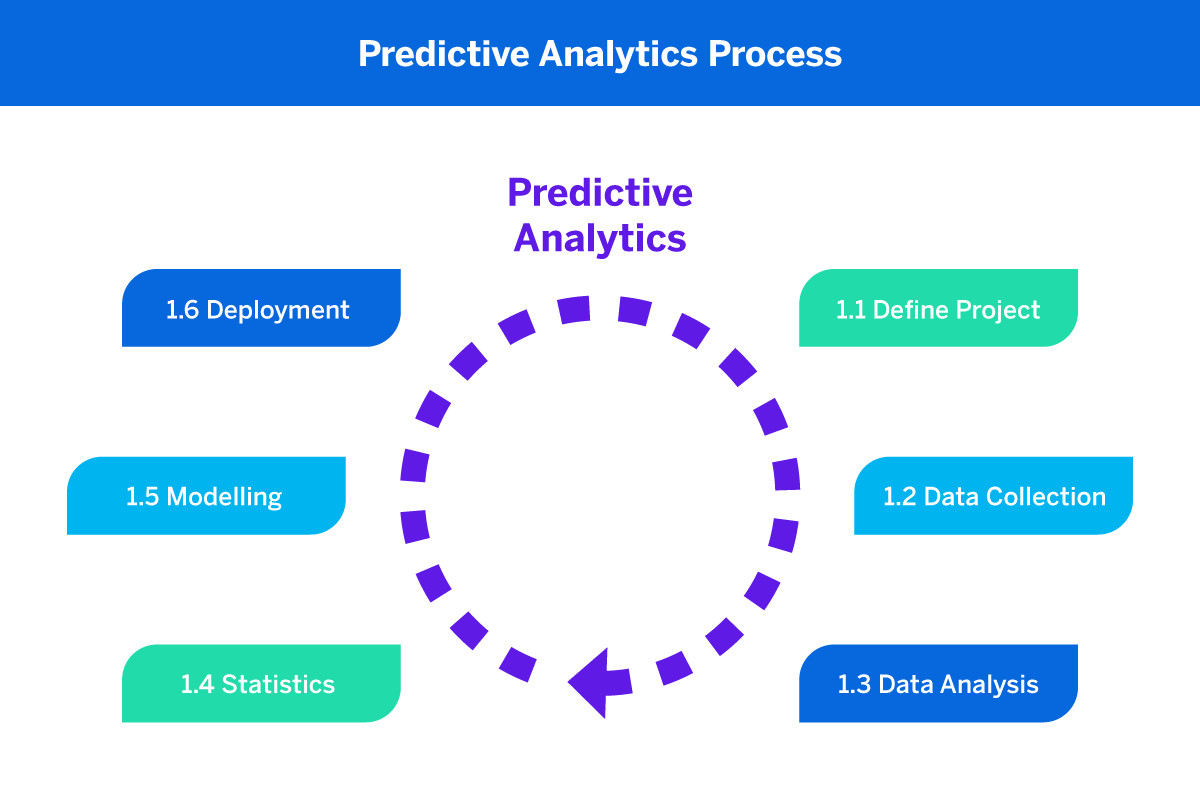

In today’s data-driven business landscape, predictive analytics has emerged as a powerful tool that is reshaping both the financial technology (Fintech) and marketing technology (Martech) sectors. At its core, predictive analytics is the practice of extracting information from existing data sets to determine patterns and predict future outcomes and trends. This sophisticated approach to data analysis is becoming increasingly crucial for companies looking to make informed decisions, forecast trends, and enhance customer experiences.

The convergence of Fintech and Martech is a testament to the evolving nature of business in the digital age. As financial services become more digitized and marketing efforts more targeted, predictive analytics serves as a bridge between these two fields, offering insights that drive innovation and growth in both sectors. By leveraging advanced algorithms and machine learning techniques, companies can now analyze vast amounts of data to gain actionable insights, leading to more efficient operations, improved risk management, and personalized customer interactions.

In the Fintech sector, predictive analytics has revolutionized various aspects of financial services. Here are some key applications:

Credit Risk Assessment

Fintech companies use predictive models to assess creditworthiness more accurately than traditional methods. By analyzing a wide range of data points, including non-traditional ones like social media activity and online behavior, these models can provide a more comprehensive view of an individual’s financial reliability.

Fraud Detection

It plays a crucial role in identifying and preventing fraudulent activities. By analyzing patterns in transaction data, machine learning algorithms can flag suspicious activities in real-time, significantly reducing the risk of financial fraud.

Customer Segmentation

Fintech firms use predictive analytics to segment their customer base more effectively. This allows for tailored financial products and services that better meet the needs of specific customer groups.

Risk Management

Predictive models help in assessing and mitigating various types of financial risks. From market risk to operational risk, these models provide valuable insights that enable better decision-making and strategy formulation.

Financial Forecasting

By analyzing historical data and current market trends, predictive analytics helps in more accurate financial forecasting. This is particularly useful for investment management and financial planning services.

Many Fintech companies have successfully implemented predictive analytics to gain a competitive edge. For instance, online lending platforms use predictive models to make instant lending decisions, while robo-advisors leverage these technologies to provide automated, algorithm-driven financial planning services.

In the Martech sphere, predictive analytics is equally transformative, offering marketers powerful tools to optimize their strategies and improve ROI. Key applications include:

Lead Scoring and Prioritization

By analyzing various data points, predictive analytics can assign scores to leads based on their likelihood to convert. This helps sales teams prioritize their efforts and focus on the most promising prospects.

Customer Lifetime Value (CLTV) Prediction

Predictive models can forecast the long-term value of a customer, helping businesses allocate resources more effectively and tailor their marketing strategies accordingly.

Campaign Optimization

Predictive analytics enables marketers to optimize their campaigns by forecasting outcomes and suggesting the best channels and timing for different audience segments.

Personalized Content and Offers

By analyzing customer behavior and preferences, predictive analytics helps in delivering personalized content and offers, significantly improving customer engagement and conversion rates.

Successful case studies in Martech abound. For example, e-commerce giants use predictive analytics to recommend products to customers, while streaming services leverage these technologies to suggest content, significantly enhancing user experience and engagement.

The synergy between Fintech and Martech through predictive analytics is creating new opportunities for businesses to enhance their operations and customer relationships. This intersection is particularly evident in the following areas:

Personalized Financial Products and Services

By combining financial data with marketing insights, companies can create a more comprehensive view of their customers. This allows for more personalized financial products and targeted marketing efforts.

Cross-Selling Opportunities

Predictive analytics can identify potential cross-selling opportunities by analyzing a customer’s financial behavior and marketing interactions. This enables financial institutions to offer relevant products at the right time through the most effective channels.

Aligned Marketing and Risk Management

Insights from financial risk models can inform marketing strategies, ensuring that marketing efforts are aligned with the company’s risk appetite and regulatory requirements.

Optimized Customer Journey

By analyzing both financial and marketing touchpoints, predictive analytics can help optimize the entire customer journey, from awareness to long-term loyalty.

Sophisticated Behavioral Targeting

Combining financial transaction data with marketing interaction data allows for more sophisticated behavioral targeting, resulting in more relevant and effective marketing campaigns.

These cross-industry use cases demonstrate how predictive analytics is blurring the lines between Fintech and Martech, leading to more integrated and customer-centric business models.

One of the most powerful applications of predictive analytics in both Fintech and Martech is customer segmentation and targeting. By analyzing vast amounts of data, companies can create detailed customer profiles and segment their audience based on various factors such as behavior, preferences, and financial status.

Customer Segmentation in Fintech and Martech

In Fintech, this could mean segmenting customers based on their risk profile, investment behavior, or financial goals. For example, a bank might use predictive analytics to identify customers who are likely to be interested in mortgage products based on their savings patterns and life stage.

In Martech, segmentation might be based on factors like purchase history, browsing behavior, or engagement with marketing content. A retailer, for instance, might use predictive analytics to identify customers who are likely to respond to a particular promotional offer based on their past interactions with the brand.

The key benefit of using predictive analytics for segmentation is the ability to move beyond simple demographic segmentation to create more nuanced and accurate customer groups. This allows for highly targeted marketing efforts and personalized financial services, ultimately leading to improved customer satisfaction and business performance.

Customer Acquisition and Retention

Predictive analytics plays a crucial role in both acquiring new customers and retaining existing ones. In the realm of customer acquisition, predictive models can:

-

Identify potential customers who are most likely to convert based on their demographics, online behavior, and other data points.

-

Forecast the success rate of different marketing campaigns, allowing for more efficient allocation of resources.

-

Optimize the targeting of marketing messages to reach the most receptive audience segments.

For customer retention, predictive analytics can:

-

Identify customers who are at risk of churning based on their recent activity, engagement levels, and other indicators.

-

Proactively reach out to at-risk customers with personalized offers or incentives to retain them.

-

Predict the likelihood of customers making future purchases or taking advantage of other services.

In both Fintech and Martech, these capabilities translate into more efficient use of resources and improved customer relationships. For example, a Fintech company might use churn prediction models to identify customers likely to close their accounts and proactively offer them personalized incentives to stay. Similarly, a marketing team might use predictive analytics to identify the best time and channel to reach out to a potential customer based on their past behavior.

Transforming Marketing Campaigns

Predictive analytics is transforming the way marketing campaigns are planned, executed, and evaluated. Key applications include:

- Campaign Performance Forecasting

By analyzing historical campaign data, predictive models can forecast the potential performance of future campaigns, helping marketers allocate resources more effectively.

- Content Optimization

Predictive analytics can determine which content is most likely to resonate with different audience segments, allowing for real-time optimization of marketing materials.

- Attribution Modeling

Advanced predictive models can more accurately attribute conversions across multiple marketing channels, providing a clearer picture of campaign effectiveness.

- Campaign Timing Optimization

Predictive analytics can determine the best times to send marketing messages to different customer segments, improving engagement rates.

These capabilities allow marketers to move from a reactive to a proactive approach, continuously optimizing their campaigns based on real-time data and predictive insights.

Risk Management and Fraud Prevention

In both Fintech and Martech, risk management and fraud prevention are critical concerns that can be significantly improved through predictive analytics. In Fintech, predictive models are used to:

-

Detect and prevent fraudulent transactions by analyzing patterns in data and identifying anomalies.

-

Assess the risk of loan defaults by evaluating borrower characteristics and market conditions.

-

Identify potential money laundering activities by analyzing transaction flows and customer behavior.

In Martech, predictive analytics helps in:

-

Identifying fraudulent activities like click fraud and account takeovers.

-

Detecting spam and malicious content.

-

Preventing unauthorized access to user accounts and sensitive data.

Tools and technologies used in this area often involve machine learning algorithms that can process vast amounts of data in real-time, identifying patterns that would be impossible for humans to detect manually.

Challenges and Opportunities in Predictive Analytics

While the benefits of predictive analytics are clear, implementing these technologies comes with several challenges:

- Data Quality

Predictive models are only as good as the data they’re based on. Ensuring high-quality, clean data is a significant challenge for many organizations.

- System Integration

Integrating predictive analytics tools with existing systems can be complex, especially for organizations with legacy infrastructure.

- Skilled Talent

There’s a shortage of professionals with the necessary skills to implement and manage predictive analytics systems effectively.

- Model Explainability

Some predictive models, especially those using deep learning, can be “black boxes,” making it difficult to explain their decisions.

- Regulations

Especially in Fintech, there are strict regulations around data use and model transparency that need to be navigated.

To overcome these challenges, organizations should:

-

Invest in data quality initiatives to ensure that the data used for predictive modeling is accurate, complete, and consistent.

-

Choose predictive analytics tools that are designed for easy integration with existing systems.

-

Recruit and develop talent with expertise in data science and machine learning.

-

Focus on developing models that are transparent and explainable, allowing for greater trust and accountability.

-

Ensure that their predictive analytics practices comply with all relevant regulations.

Emerging Trends in Predictive Analytics

The field of predictive analytics is rapidly evolving, driven by advancements in AI and machine learning. Some emerging trends include:

- Explainable AI (XAI)

As the need for transparency grows, there’s a push towards AI models that can explain their decision-making processes.

- Real-time Predictive Analytics

The ability to process and act on data in real-time is becoming increasingly important, especially in fast-moving fields like Fintech and Martech.

- Edge Computing

Processing data closer to where it’s generated (on devices or local servers) is becoming more prevalent, reducing latency and improving privacy.

- Automated Machine Learning

Tools that automate the process of creating and tuning machine learning models are making predictive analytics more accessible to non-experts.

- Federated Learning

This approach allows for training models across multiple decentralized devices or servers holding local data samples, without exchanging them, addressing privacy concerns.

These innovations promise to make predictive analytics even more powerful and accessible in the coming years, further driving the convergence of Fintech and Martech.

Ethical Considerations

While the benefits of predictive analytics are clear, it’s crucial to consider the ethical implications of its use. Key concerns include:

- Data Privacy

The use of personal data for predictive modeling raises significant privacy concerns. Organizations need to be transparent about data collection and use, and ensure they’re complying with regulations like GDPR.

- Algorithmic Bias

Predictive models can inadvertently perpetuate or amplify existing biases present in their training data. It’s crucial to regularly audit models for bias and take steps to mitigate it.

- Model Transparency

Especially in Fintech, where predictive models may be making decisions that significantly impact people’s lives (like loan approvals), there’s a growing demand for model transparency and explain ability.

- User Consent

Users should be made aware when their data is being used for predictive modeling and given the option to opt out.

- Data Security

With the valuable insights provided by predictive analytics comes the responsibility to protect this data from breaches and misuse.

To address these concerns, organizations should:

-

Implement strong data privacy and security practices.

-

Regularly audit their models for bias and take steps to mitigate any identified issues.

-

Promote transparency in their use of predictive analytics and provide clear explanations of how these models work.

-

Obtain informed consent from users before using their data for predictive modeling.

Measuring the Impact of Predictive Analytics

To justify investment in predictive analytics and continually improve its application, it’s crucial to measure its impact effectively. Key performance indicators (KPIs) to track include:

- Customer Acquisition Cost (CAC)

How has predictive analytics affected the cost of acquiring new customers?

- Customer Lifetime Value (CLTV)

Has predictive analytics improved the long-term value derived from customers?

- Churn Rate

How effective are predictive models in reducing customer churn?

- Conversion Rate

Have predictive models improved the rate at which leads convert to customers?

- Default Rates and Fraud Detection Rates (Fintech)

For Fintech, how has predictive analytics impacted metrics like default rates or fraud detection rates?

- Campaign ROI (Martech)

How has the return on investment for marketing campaigns changed with the implementation of predictive analytics?

- Customer Satisfaction

Has the use of predictive analytics for personalization and targeting improved overall customer satisfaction?

When evaluating the success of predictive analytics strategies, it’s important to establish a baseline before implementation and continuously monitor these metrics over time. It’s also crucial to consider both short-term gains and long-term strategic benefits.

Integrating Predictive Analytics into Your Systems

The successful implementation of predictive analytics often hinges on how well it integrates with existing systems. Here are some key considerations:

- Data Accessibility

Ensure that your predictive analytics tools can easily access and process data from all relevant sources in your organization.

- API Integration

Look for tools that offer robust APIs for seamless integration with your existing software.

- Scalability

Choose solutions that can grow with your organization and handle increasing data volumes.

- User Interface

Consider how the predictive analytics tools will be used and by whom. The interface should be accessible to the intended users.

- Security

Ensure that the integration doesn’t create new security vulnerabilities.

When selecting predictive analytics tools, involve stakeholders from IT, data science, and the end-user departments to ensure that the chosen solution meets all necessary requirements and integrates smoothly with your existing infrastructure.

Data Visualization and Communication

Data visualization plays a crucial role in making predictive analytics insights accessible and actionable. While predictive models can process vast amounts of data and identify complex patterns, the insights they generate need to be communicated effectively to decision-makers who may not have a technical background.

Effective data visualization can:

-

Help decision-makers quickly understand the key findings of predictive models.

-

Make it easier to identify trends and patterns in data.

-

Facilitate the communication of complex insights in a clear and concise way.

When implementing predictive analytics, it’s important to invest in robust data visualization tools that can present the outputs of your models in clear, interactive formats. This might include dashboards showing real-time predictions, interactive charts allowing users to explore different scenarios, or heat maps highlighting key risk areas.

The Future of Predictive Analytics in Fintech and Martech

As we’ve explored throughout this post, predictive analytics is serving as a powerful catalyst for the convergence of Fintech and Martech. By enabling more accurate forecasting, enhanced personalization, and improved risk management, predictive analytics is breaking down the traditional silos between these two sectors.

This convergence is leading to more holistic, customer-centric business models where financial services and marketing efforts are closely aligned and mutually reinforcing. Companies that can effectively leverage predictive analytics across both domains stand to gain a significant competitive advantage, delivering more value to their customers while optimizing their own operations.

However, the journey to fully realizing the potential of predictive analytics is not without its challenges. From data quality issues and integration complexities to ethical considerations and the need for skilled talent, organizations must navigate a complex landscape.

Despite these challenges, the potential rewards make the pursuit of predictive analytics capabilities well worth the effort. As AI and machine learning technologies continue to advance, we can expect even more powerful and accessible predictive analytics tools to emerge, further driving innovation in both Fintech and Martech.

For businesses looking to thrive in this new landscape, now is the time to start exploring how predictive analytics can be integrated into your strategies. Whether you’re a Fintech company looking to enhance your risk management capabilities, a marketing team seeking to optimize your campaigns, or a business leader aiming to create more synergy between your financial and marketing operations, predictive analytics offers a path forward.

By embracing these technologies and the insights they provide, businesses can not only improve their current operations but also position themselves to adapt and thrive in an increasingly data-driven future. The intersection of Fintech and Martech through predictive analytics isn’t just a trend—it’s the future of business in our digital age.

Conclusion

As we look ahead, it’s clear that the companies that will lead in both the Fintech and Martech sectors will be those that can most effectively harness the power of predictive analytics. They will be the ones who can turn vast amounts of data into actionable insights, who can anticipate customer needs before they arise, and who can navigate complex risk landscapes with confidence.

But beyond just adopting the technology, success will come to those who can use predictive analytics to fundamentally reimagine their business models. This might mean creating new, hyper-personalized financial products based on predictive insights about customer behavior. Or it could involve developing marketing strategies that seamlessly integrate with financial services, creating a cohesive customer experience across all touchpoints.

The key is to view predictive analytics not just as a tool, but as a lens through which to view your entire business. It’s about asking new questions, challenging old assumptions, and being willing to fundamentally rethink how you create and deliver value to your customers.

As you embark on this journey, remember that implementing predictive analytics is not a one-time project, but an ongoing process of learning, adaptation, and refinement. Start small, focus on clear use cases with measurable outcomes, and be prepared to iterate as you learn.

Also, don’t underestimate the importance of building a data-driven culture within your organization. The most sophisticated predictive models in the world won’t deliver value if your team isn’t ready to act on the insights they provide. Invest in training, foster a culture of experimentation, and ensure that data-driven decision making is embedded at all levels of your organization.

Finally, as you push the boundaries of what’s possible with predictive analytics, never lose sight of the ethical implications of your work. As custodians of vast amounts of customer data, Fintech and Martech companies have a responsibility to use that data in ways that respect privacy, promote fairness, and create genuine value for customers.

The convergence of Fintech and Martech through predictive analytics represents a significant opportunity. It’s a chance to create more efficient, more responsive, and more customer-centric businesses. But more than that, it’s an opportunity to reimagine the very nature of financial services and marketing in the digital age.

The future belongs to those who can seize this opportunity, who can bridge the worlds of finance and marketing with data-driven insights, and who can use predictive analytics to not just react to change, but to actively shape the future of their industries.

As we stand at this intersection of Fintech and Martech, powered by the capabilities of predictive analytics, the possibilities are truly exciting. The question now is: how will you use these powerful tools to transform your business and create new value for your customers?

The journey of predictive analytics in Fintech and Martech is just beginning. As technology continues to evolve, as our understanding of data science deepens, and as we discover new ways to apply these insights, we can expect to see even more innovative applications emerge.

For instance, we might see the rise of “predictive banking” where financial institutions use AI to anticipate customer needs and proactively offer services. Or we could witness the development of “cognitive marketing” where campaigns are not just personalized, but are dynamically created in real-time based on predictive models of customer behavior.

Moreover, as the Internet of Things (IoT) continues to expand, we’ll have access to even more data points, allowing for even more accurate and nuanced predictive models. Imagine a world where your financial advisor can offer advice based not just on your bank statements, but on data from your smart home, your fitness tracker, and your shopping habits.

However, with great power comes great responsibility. As predictive analytics becomes more pervasive and powerful, it will be crucial for businesses to maintain a strong ethical framework. This includes being transparent about how data is being used, ensuring that predictive models don’t perpetuate biases, and always prioritizing the customer’s best interests.

Education will also play a key role in the future of predictive analytics. As these technologies become more central to business operations, there will be a growing need for professionals who can bridge the gap between data science and business strategy. Companies that invest in developing this talent internally, or in partnering with educational institutions to create relevant training programs, will be well-positioned for success.

Collaboration will be another key theme. As the lines between Fintech and Martech continue to blur, we’re likely to see more partnerships between companies in these sectors. These collaborations could lead to innovative new products and services that leverage the strengths of both fields.

Regulatory frameworks will also need to evolve to keep pace with these technological advancements. We can expect to see new guidelines and standards emerge around the use of predictive analytics, particularly in sensitive areas like financial decision-making and personal data use.

In conclusion, the intersection of Fintech and Martech through predictive analytics represents a new frontier in business. It offers the potential to create more value, deliver better customer experiences, and drive innovation across both sectors. But realizing this potential will require more than just technological know-how. It will demand creativity, ethical consideration, and a willingness to reimagine traditional business models.

As we move forward into this data-driven future, the most successful companies will be those that can balance the power of predictive analytics with a deep understanding of human needs and behaviors. They will be the ones who use data not just to predict the future, but to create a better one for their customers and for society as a whole.

The convergence of Fintech and Martech through predictive analytics is not just changing how we do business—it’s changing how we think about the relationship between businesses and customers. It’s creating a world where financial services and marketing are not separate disciplines, but part of a seamless, data-driven approach to meeting customer needs.

As you consider how to leverage these powerful tools in your own organization, remember that the goal is not just to predict behavior, but to understand it. Not just to react to customer needs, but to anticipate and fulfill them. And not just to use data, but to create value from it.

The future of Fintech and Martech is here, and it’s powered by predictive analytics. The question is: are you ready to seize the opportunities it presents?