Rolls-Royce Share Price: Potential for Skyrocketing Following Earnings Release

The Rolls-Royce (LSE: RR) share price has taken a breather lately, but Harvey Jones believes that its first-half results will get the FTSE 100 stock moving again.

The speculative froth has gone out of the Rolls-Royce (LSE: RR) share price, which has fallen 3.33% in the last week. A pullback was inevitable, given the speed at which it has skyrocketed over the last few years.

Yet the dip wasn’t purely down to a shift in sentiment. It was also triggered by disappointing update from Airbus on 24 June, which noted that Rolls-Royce engines for its A330neo wide-body airliner were behind schedule.

Key Insights:

- Rolls-Royce's first-half results, to be released on August 1, could significantly impact the share price.

- The company forecasts an underlying operating profit of between £1.7bn and £2bn for 2024, potentially leading to a share price surge if exceeded.

- The aviation sector's recovery and increased defense spending have been tailwinds for Rolls-Royce.

- Analysts remain positive on Rolls-Royce, with a median price target of 532.5p, indicating a potential 21.1% increase from current levels.

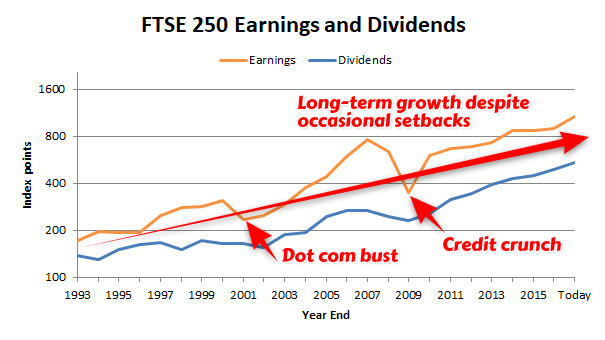

Investors are still sitting on spectacular gains, though, with Rolls-Royce shares up 130.06% over one year and 397.8% over two.

We should have a clearer idea of where the FTSE 100-listed aircraft engine maker goes next tomorrow, and I’ll be watching like a hawk.

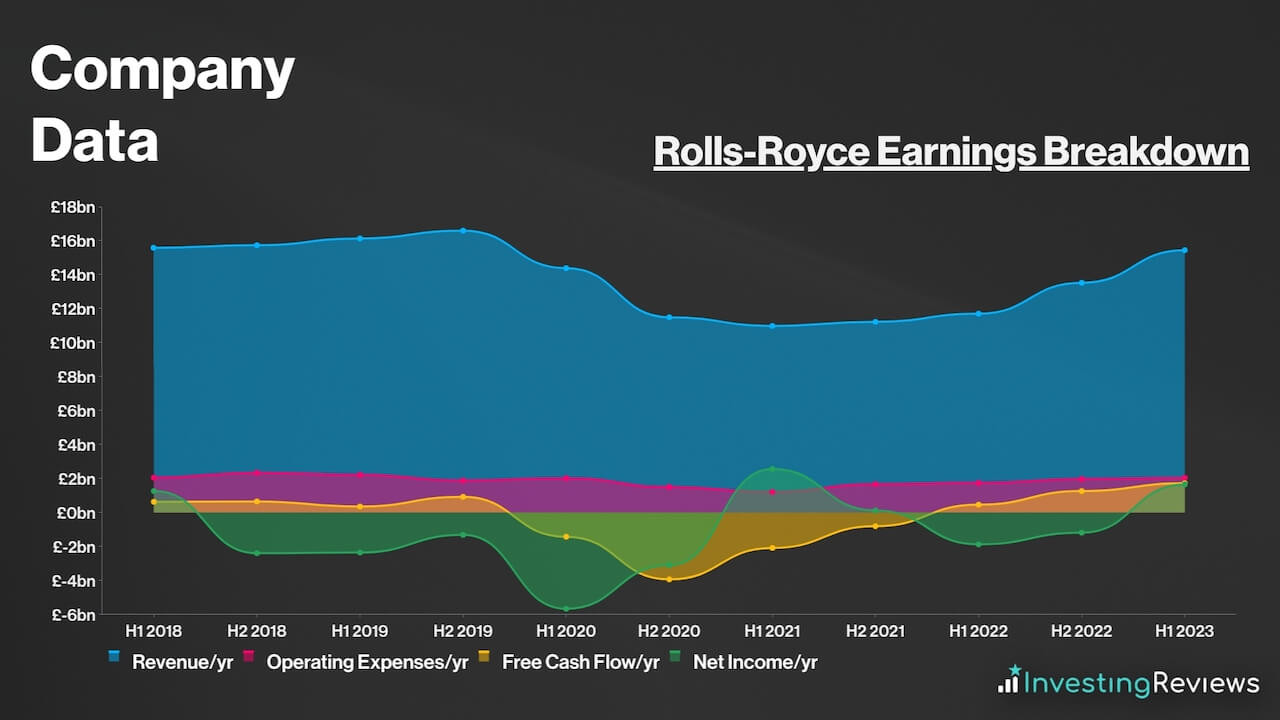

On 1 August, Rolls-Royce publishes its first-half results. In February, it forecast an underlying operating profit of between £1.7bn and £2bn for 2024. That’s up from £1.6bn in 2023, giving a potential growth range of between 6% and 25%. Tomorrow, we’ll discover if CEO Tufan Erginbilgiç is on track to achieve that.

Now that’s a pretty wide range, if you ask me. It leaves a lot of scope for the share price to skyrocket if Rolls-Royce beats the upper end of guidance – or plunge if it comes up short.

There are reasons to be optimistic though, as the world starts flying again. That should boost demand for Rolls-Royce’s engines. Better still, maintenance contracts, which is where the real money is, are based on miles flown.

I’ll be looking for signs that the company’s order book and backlog is still growing. Hopefully, there’ll be a few contract wins to report. I’ll also be looking for an update on CEO Tufan Erginbilgiç’s restructuring and cost-cutting measures.

I have concerns too. Post-pandemic global supply chain disruptions rumble on, which could hit delivery of the parts and materials Rolls-Royce needs to build its engines. And it still faces issues over the reliability of its Trent 1000 and Trent 7000 engines.

Rolls-Royce, like the entire aviation sector, is also at the mercy of geopolitics. That’s a real worry, given news that Israel has killed Hamas political leader Ismail Haniyeh in Tehran. On the other hand, our increasingly threatening world can only boost the company’s defence division.

I sold my Rolls-Royce shares last year after making a 200% profit but could have doubled that if I’d stood by them. I needed the money then but now I’ve got cash to invest and I’m waiting for the right moment.

Today, I view Rolls-Royce as a long-term share price growth and dividend income play. It has a heap of opportunities, including the AUKUS submarine programmes, which include Rolls-Royce reactors, and its planned fleet of mini nuclear power plants.

The shares aren’t cheap with a price-to-earnings (P/E) ratio of 32.34 times trailing earnings. That’s higher than sector peer BAE Systems (21.43 times), General Dynamics (22.62),and Northrop Grumman (18.99), but notably cheaper than RTX (65.87).

I’ll be poring over tomorrow’s results before the market opens. If they look good, I’ll click the Buy button. If they undershoot, I’ll bide my time and take advantage of any dip. And this time, I won’t sell.

Analyst Outlook:

The consensus among analysts remains positive. Forecasts collected by the Financial Times in July show that, among a group of 18 analysts, four rated Rolls-Royce shares a ‘buy’, 10 ranked them ‘outperform’, three labelled them a ‘hold’, and only one gave them an ‘underperform’ rating. There were no ‘sell’ ratings in the sample.

Furthermore, of the 16 analysts who offered a 12-month price target for Rolls-Royce shares, the median estimate of 532.5p represents a 21.1% increase from the closing price of 439.8p on 29 July. The high estimate of 600p implies a 36.4% increase, while the low estimate of 240p would represent a 45.4% decrease.