The Tokenized Asset Coalition Expands, Releases 2024 State of Tokenization Report

The Tokenized Asset Coalition (TAC), a prominent advocate for public blockchain adoption, asset tokenization, and institutional DeFi, has made significant progress by announcing the addition of 21 new members and releasing its highly anticipated second State of Tokenization report. The report provides a comprehensive overview of the latest trends in the tokenization industry, including the critical role of regulation, growing institutional interest, and key breakthroughs in the sector.

Regulatory Frameworks Drive Adoption

The report delves into the pivotal role that regulatory frameworks play in driving blockchain technology adoption. It highlights that clear and consistent regulations create a more predictable and stable environment for institutional investors, fostering greater confidence and encouraging broader participation. As the industry matures, regulatory frameworks are becoming increasingly essential in building trust and credibility, paving the way for widespread adoption of tokenized assets.

Institutional Interest in Tokenization Soars

The report underscores the growing interest of institutional investors in bringing assets on-chain. A recent Coinbase survey of Fortune 500 CEOs found that 56% of organizations are actively working on on-chain initiatives. This surge in institutional interest signals a paradigm shift in the way capital is managed, with traditional financial institutions increasingly embracing the potential of blockchain technology. The report emphasizes that the growing institutional participation in tokenization is driving innovation and accelerating the development of a more robust and scalable ecosystem for tokenized assets.

Tokenization: A $2 Trillion to $30 Trillion Market

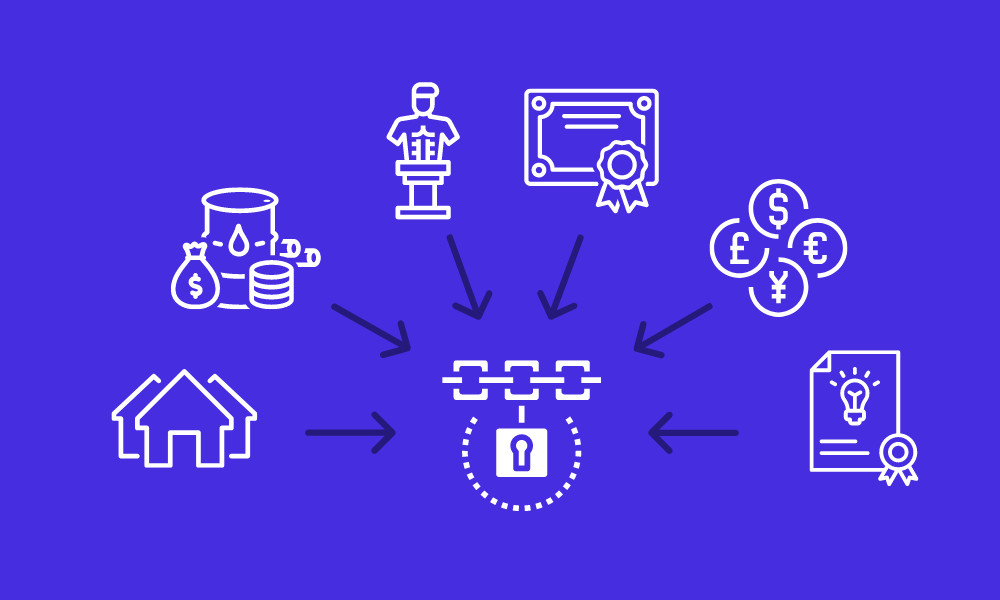

The report highlights the remarkable growth potential of the tokenized asset market. Major financial organizations, such as McKinsey, Citi, and Standard Chartered, project that the market will expand to an astounding $2 trillion to $30 trillion over the next decade. This projection underscores the transformative power of tokenization and its ability to revolutionize traditional financial systems. The report emphasizes that the potential for growth is fueled by the increasing adoption of blockchain technology and the expanding range of assets that can be tokenized.

Ondo Finance Leads in Tokenized US Treasury

Ondo Finance, a leading participant in the Tokenized Asset Coalition, has emerged as a major player in the tokenization industry. The report highlights Ondo Finance's ground-breaking products, USDY and OUSG, which have played a significant role in driving the growth of tokenized US Treasuries. Ondo Finance's innovations in this area are seen as a testament to the potential of on-chain finance to revolutionize traditional investment options. The report emphasizes that Ondo Finance's success in tokenizing US Treasuries is a significant milestone for the industry, demonstrating the growing maturity and versatility of tokenized assets.

Nayms Joins the Tokenized Asset Coalition

Nayms, a leading crypto-native (re)insurance marketplace, has joined the Tokenized Asset Coalition, aligning itself with the organization's vision for a more open, fair, and transparent financial system. Nayms has played a pivotal role in transforming the tokenized asset industry by bridging traditional insurance markets and blockchain technology, unlocking access to over $2tn in alternative capital through the tokenization of real-world insurance programs. The company's unique approach to tokenization, combined with its regulatory expertise, positions Nayms to make significant contributions to the future of decentralized finance and asset tokenization. Nayms's entry into the TAC underscores the growing appeal of the organization as a platform for collaboration and innovation in the tokenization industry.

The Future of On-Chain Finance

The Tokenized Asset Coalition's second State of Tokenization report paints a compelling picture of the future of on-chain finance. The report's findings highlight the growing adoption of tokenized assets, the increasing interest of institutional investors, and the transformative potential of blockchain technology to revolutionize traditional financial systems. The report's insights provide valuable guidance for investors, entrepreneurs, and policymakers alike, as they navigate the rapidly evolving landscape of decentralized finance and asset tokenization.

The Power of Collaboration

The Tokenized Asset Coalition's success is a testament to the power of collaboration. By bringing together leading organizations in the blockchain and financial industries, the TAC is driving innovation and accelerating the adoption of tokenized assets. The organization's commitment to fostering an open and transparent ecosystem is creating new opportunities for investors, businesses, and the broader financial community.

A New Era of Finance

The tokenization industry is poised for explosive growth, with the potential to redefine the way we invest, manage capital, and access financial services. The Tokenized Asset Coalition is at the forefront of this revolution, driving innovation and shaping the future of finance. As the industry continues to evolve, the TAC will remain a vital force, working to create a more open, fair, and accessible financial system for all.