UK inflation fell unexpectedly to 1.7% in the year to September, the lowest rate in three-and-a-half years. Lower airfares and petrol prices were the main drivers behind the surprise slowdown, official figures showed. It means inflation - the rate prices rise at over time - is now below the Bank of England's 2% target, paving the way for interest rates to be cut further next month.

September's figure is normally used to set how much many benefits rise next April. This includes the biggest: Universal Credit, which goes up at ministers' discretion. All the main disability benefits - personal independence payment, attendance allowance and disability living allowance - as well as carer’s allowance, go up by at least September's inflation rate by law. But a rise of 1.7% for benefits would be less than April's expected rise in the state pension of 4.1%, which is determined by the so-called triple lock.

The Office for National Statistics (ONS) said petrol and diesel prices were significantly lower, dropping by 10.4% in September compared with the same month a year earlier. The cost of fares for domestic, European and long-haul flights also dragged down the inflation rate. Fares normally fall after the summer rush, but they fell more than normal. However, households were hit by an uptick in the pace of food and non-alcoholic drink price rises, with costs jumping for milk, cheese, eggs, soft drinks and fruit.

Chief secretary to the Treasury, Darren Jones, said the drop in the pace of price rises overall would be “welcome news for millions of families”. “However, there is still more to do to protect working people, which is why we are focused on bringing back growth and restoring economic stability to deliver on the promise of change,” he added.

Falling inflation does not mean the prices of goods and services overall are coming down, it is just that they are rising at a slower pace.

Impact on Interest Rates

With inflation falling lower than most economists expected, markets have been “piling on” bets for an interest rate cut when the Bank of England next meets in November, according to Susannah Streeter, head of money and markets at Hargreaves Lansdown. “A quarter percentage point cut is pretty much nailed on, and expectation of a second rate cut in December has also jumped up today,” added Danni Hewson, head of financial analysis at AJ Bell.

UK interest rates are currently at 5%. The Bank had raised them steadily from the end of 2021 as inflation surged, partly due to the increase in energy prices following Russia's invasion of Ukraine. It made a first cut in August and decided to hold them last month, however, Yael Selfin, chief economist at KPMG UK, said September's inflation rate drop would be “enough” for policymakers to make a further reduction in November.

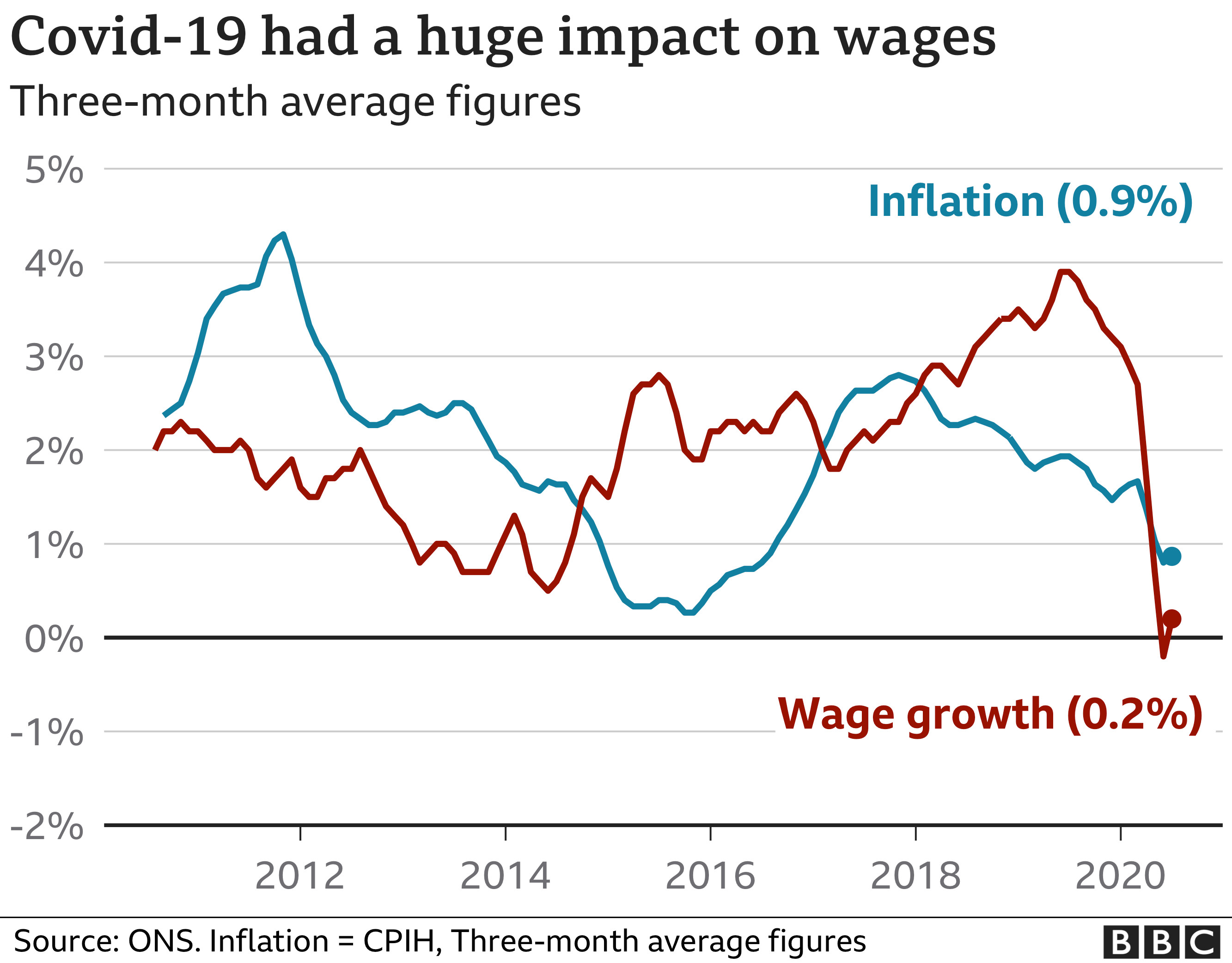

However, she said that inflation was likely to rise again with household energy bills increasing this month by around 10%. The government is facing criticism by businesses over a potential tax rise that would fall on employers. Expectations of a rate cut next month increase as pay growth slows to its lowest rate for more than two years.

Budget Implications

The surprise fall in the UK's inflation rate comes ahead of this month's Budget, with Chancellor Rachel Reeves looking to make to make tax rises and spending cuts to the value of £40bn. Reeves, who is finalising details of her first Budget on 30 October, warned ministers there would be “difficult decisions on spending, welfare, and tax”. She is drawing up plans to find £40bn to avoid real-terms cuts to government departments.

Looking Ahead

While the recent drop in inflation is a positive sign, the outlook remains uncertain. The Bank of England will be carefully monitoring the situation to determine the appropriate course of action. Any unexpected developments, such as a further rise in energy prices or a change in global economic conditions, could impact the trajectory of inflation and the timing of any interest rate cuts.

The Chancellor's upcoming budget is also likely to have a significant impact on the economy. The government's plans for tax rises and spending cuts could influence inflation and growth prospects in the months to come. As the UK navigates its economic path, the coming months will be crucial for understanding the long-term implications of these developments.