Cross-border payments are the payments that everyone loves to hate. They are routinely described as expensive, slow, and opaque. In the bustling heart of Istanbul, thousands of miles from home, John finds himself in a charming street bazaar. His eyes light up with curiosity as he stumbles upon a family-owned shop adorned with colourful fabrics and exquisitely handcrafted souvenirs. An impulse to buy a piece of local treasure overtakes him, and he selects a beautiful tapestry. As he approaches the shopkeeper to complete his transaction, a moment of hesitation descends. John wonders, ‘How much will this cost in my local currency? Can I trust the exchange rates offered here?’ These questions dance in his mind, casting a shadow over what should be a joyful experience. In this bustling street market, John's troublesome situation mirrors the daily struggle faced by countless individuals, businesses, and communities worldwide.

Cross-border payments, though essential in our interconnected world, often face issues like delays, exorbitant costs, and a frustrating lack of transparency. But in the background of this story lies the promise of change, a transformation that can reshape the way we move money across borders.

Understanding Cross-Border Payments

Cross-border payments involve transactions between parties located in different countries. This type of payment often involves challenges like the ones encountered by our tourist – John – plus obscure bank codes, unfamiliar account formats, and requests for seemingly irrelevant details. If you've ever sent one, you might remember having to specify who bears the charges, only to find that the recipient’s bank still deducted additional fees.

The Growth of Cross-Border Payments

Over the past few decades, demand for cross-border payments has sky-rocketed. Now, we shop from online merchants based halfway across the globe. Additionally, 200 million international migrant workers send around USD 600 billion annually to their home countries, while over 5 million international students pay for tuition and living expenses abroad. In 2023, international payment flows reached an eye-watering USD 190 trillion, with projections anticipating a rise to USD 290 trillion by 2030. In the retail sector, B2B ecommerce is forecasted to grow by 120%, followed by B2C payments at 83%.

Despite the dramatic shift in global economic activity, payment systems have not kept pace. This is surprising given our current technology: we can email, chat, and video call anyone worldwide in real-time, often at little to no cost. We can withdraw local currencies from ATMs around the globe using debit cards and pay instantly in virtually any shop with credit cards.

The Challenges of Interoperability

Payment interoperability issues result from legacy systems, regulation, market fragmentation, and technological advancement. Achieving interoperability between different payment systems requires collaboration between governments, banks, and the payments and the fintech industry to ensure solutions benefit businesses and consumers alike.

The Importance of Payment Interoperability

Payment interoperability is key to driving economic growth. It enables global exchange, expands market reach, reduces transaction costs, and fosters innovation. Payment interoperability is helping enhance one of the most critical global money movement flows – cross-border remittances. The money flows represent a significant segment of retail cross-border payments, estimated at USD 857 billion in 2023, compared to USD 728 billion in 2017. According to the World Bank, the top recipients of remittances are India, Mexico, China, the Philippines, and Pakistan.

Still, globally, the average cost of sending USD 200 in the second quarter of 2023 Q2 was equivalent to 6.3% of the amount sent, up slightly from 6.1% a year ago, the Thunes’ white paper specifies. Banks are often the costliest channel for sending remittances, followed by post offices, money transfer operators, and mobile operators. However, many of these remittance providers are investing in novel ways to lower costs for consumers.

In the realm of C2B cross-border payments, consumers want to pay using their preferred payment methods. According to a PayPal survey, 40% of online shoppers indicated that they would abandon a purchase if their preferred payment method were unavailable. Furthermore, a Visa survey revealed that just half of the surveyed merchants possess a payment processing infrastructure suitable for cross-border transactions. Supporting the challenges of cross-border payments, the whitepaper offers similar statistics for B2B payments and B2C.

Key Players in Cross-Border Payments

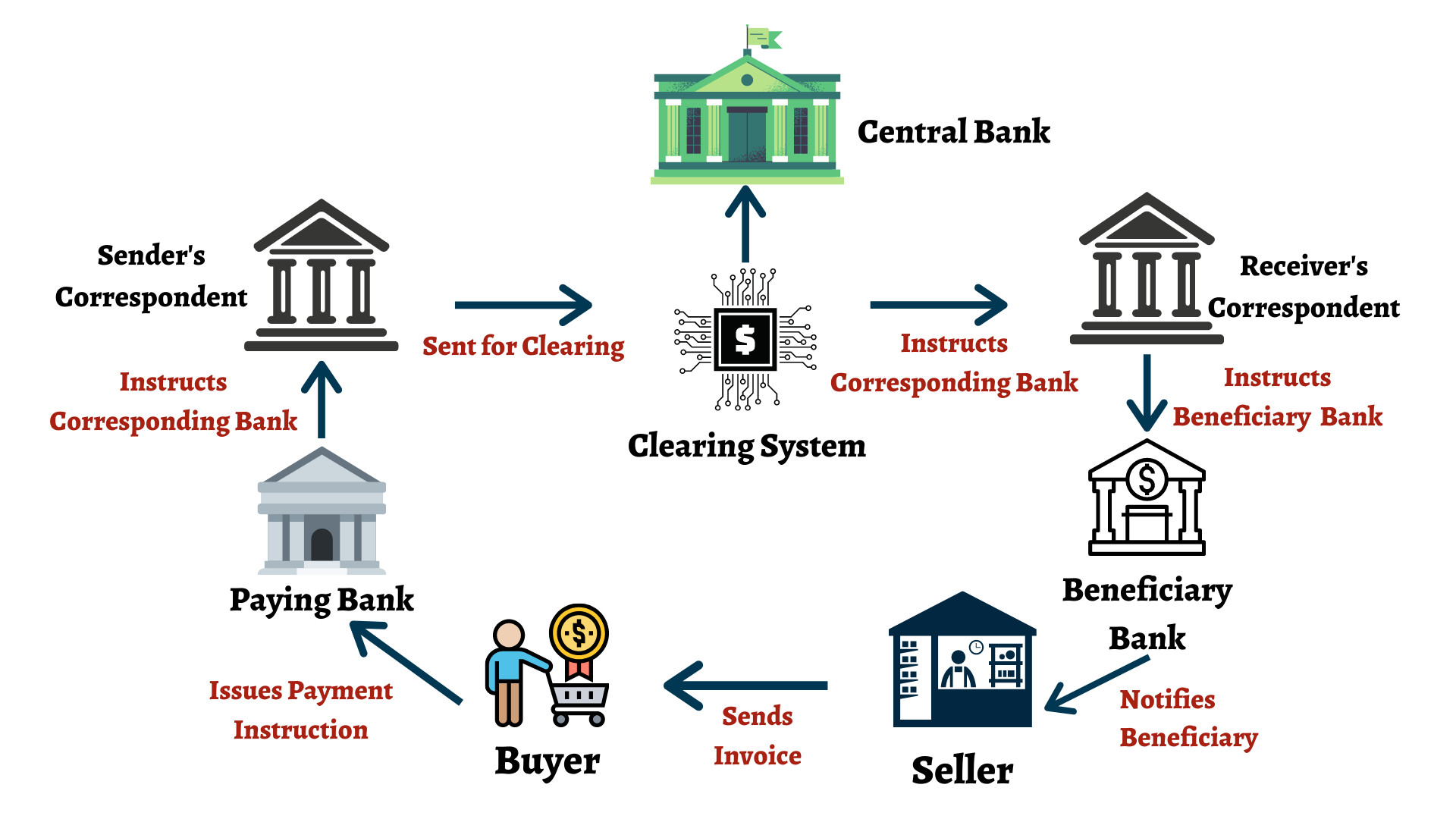

Facilitating a cross-border payment is complex, involving multiple participants, with interoperability varying widely across countries and regions. Some of the most important participants highlighted by the whitepaper include:

Central banks

Central banks, including the US Federal Reserve, the European Central Bank (ECB), and the Monetary Authority of Singapore, play a vital role in regulating and operating national payment systems. Additionally, central banks are increasingly investigating the use of central bank digital currencies (CBDCs) for cross-border payments.

SWIFT

SWIFT is a global messaging network used for international payments. It connects over 11,000 banks, financial institutions, and corporations across 200 countries. To enhance cross-border payments, SWIFT has introduced several initiatives in recent years. In 2017, it launched the SWIFT Global Payments Interface (GPI), which improves settlement times and transparency for cross-border transactions. In 2021, SWIFT introduced SWIFT Go, an upgraded system like SWIFT GPI, specifically designed to support low-value payments.

Other participants named include payments rails and initiatives, card networks, fintechs, digital wallets, blockchain technology, and providers.

Blockchain and Digital Currencies: Reshaping the Landscape

Blockchain offers a decentralised, secure, and efficient foundation for payment interoperability. Traditional financial systems often rely on correspondent banks and clearinghouses to facilitate cross-border transactions, leading to delays and higher costs. With blockchain, payments can be executed directly between parties, reducing reliance on intermediaries and enhancing interoperability.

Global Advancements in Payment Infrastructure

Moreover, global advancements in payment infrastructure are reducing friction and the costs associated with cross-border transactions. A trend in this space is the emergence of faster payment systems, enabling real-time transaction settlements. More than 80 countries have launched instant payment schemes, with prominent examples including the US, UK, Brazil, China, India, Nigeria, Hong Kong, and Australia.

Policy and Regulatory Initiatives

The G20 has been at the forefront of efforts to enhance payment interoperability for cross-border transactions. Working through the Financial Stability Board (FSB) has developed a roadmap outlining concrete actions and commitments from G20 member countries aimed at boosting the efficiency, accessibility, and affordability of cross-border payments.

Industry Standards: Paving the Way for Interoperability

Industry standards, such as EMVCo and ISO 20022, play significant roles in facilitating payment interoperability by providing common frameworks, specifications, and protocols to enable different payment systems, devices, and entities to transact seamlessly. ISO 20022 has gained widespread adoption for standardising payment messages across various systems, which traditionally use varying formats. This standardisation reduces miscommunication and increases transparency, as ISO 20022 allows for richer data quality, including details like payment purpose, party identification, and transaction references.

Innovative Solutions for Cross-Border Payments

When it comes to consumer-to-consumer (C2C) cross-border payments, Money Transfer Operators (MTOs), remittance companies, and banks employ various strategies to enable inexpensive, fast, and secure money transfers between people in different countries.

Also, stablecoins and cryptocurrencies have the potential to significantly impact and improve the remittance sector. For instance, in several African countries’ cryptocurrencies have gained popularity as a primary choice for sending money back home. Many individuals across the continent are now embracing cryptocurrencies as their preferred method for receiving funds.

It's important to note that while cryptocurrencies offer significant benefits, they also come with challenges and considerations, such as volatility (though stablecoins, which are pegged to fiat currencies like the US dollar, mitigate this issue to some extent), regulatory compliance, wallet security, infrastructure and adoption (cryptocurrency infrastructure, including exchanges and wallet providers, may not be readily available in all regions, limiting access for some individuals).

There are several cross-border payments initiatives happening across the globe that aim to make international financial interactions simpler. The ASEAN Bankers Association (ABA) has led an effort to create an interoperable QR code. Their primary objective is to provide low-cost and convenient cross-border payments across ASEAN and further facilitate intercountry trade and tourism.

Besides these initiatives, payment infrastructure firms like Thunes, have built a global network with local expertise and compliance to make cross-border transactions more efficient and interoperable.

The Future of Cross-Border Payments

Payment interoperability aims to build a seamless global financial network where money moves quickly and cost-effectively for both individuals and businesses. Achieving this goal is complex, as payment systems are complex, with a variety of technologies, regulations, and local adaptations. Moreover, emerging technologies like blockchain and digital currencies are rapidly evolving, often outpacing existing systems.

To advance payment interoperability, collaboration among governments, banks, technology companies, and regulators is essential. Harmonising payment standards will prevent disparate systems from becoming siloed and foster a more connected and efficient global payments ecosystem.