Vanguard's Innovative Rebalancing Strategy for Target-Date Funds

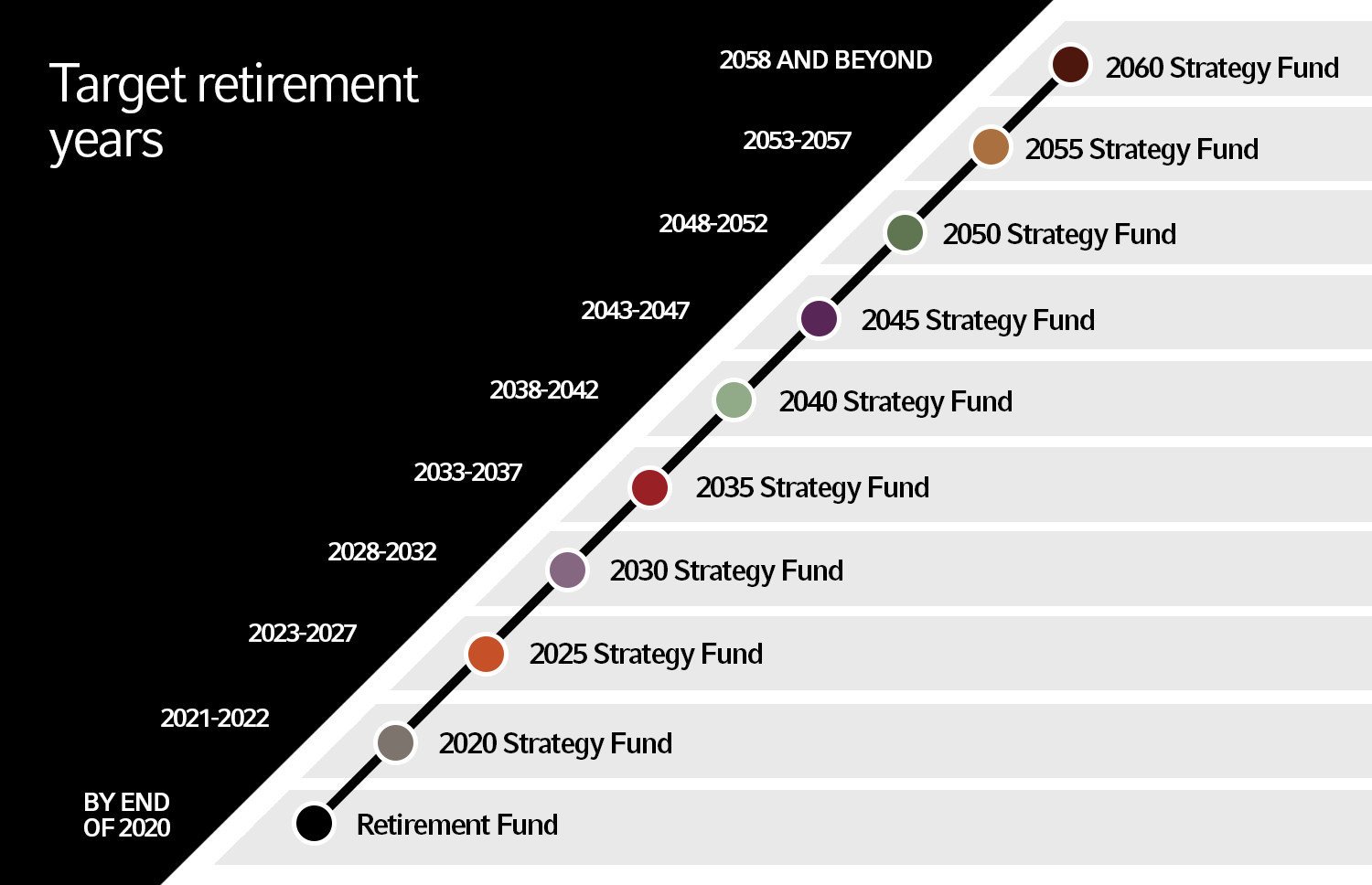

Target-date funds (TDFs) have become increasingly popular as a convenient and professionally managed investment solution for retirement planning. These multi-asset portfolios are designed to automatically adjust their asset allocation over time, aiming to provide investors with a suitable mix of growth and defensive assets based on their retirement horizon. However, the effectiveness of a TDF's rebalancing strategy is critical to achieving optimal long-term outcomes.

Understanding the Importance of Rebalancing

The core purpose of rebalancing in a TDF is to maintain the intended risk exposure. As market conditions change, and the returns of underlying asset classes diverge, the portfolio's allocation can drift away from its target. This drift can lead to unintended risk exposure and suboptimal returns. Without regular rebalancing, portfolios may become overly concentrated in certain asset classes, increasing volatility and potentially harming long-term growth.

Vanguard's 200/175 Threshold-Based Rebalancing Strategy

Vanguard has introduced a groundbreaking approach to TDF rebalancing: a threshold-based strategy employing a 200/175 method. This innovative technique sets a threshold of 200 basis points (bps) – or 2% -- from the target allocation before initiating a rebalance. The goal is to bring the portfolio back to a destination of 175 bps, or 1.75%, from the target. This system significantly differs from traditional calendar-based rebalancing which rebalances at fixed intervals, regardless of market movements. The benefits are numerous:

Reducing Transaction Costs and Allocation Drifts

By implementing the 200/175 policy, Vanguard aims to decrease the frequency of trades. This directly reduces transaction costs, thereby increasing the overall return. Simultaneously, this strategy effectively minimizes allocation drifts. Maintaining the portfolio within a closer range of the target allocation (2% compared to larger deviations in traditional methods) mitigates unwanted risk exposure.

Enhancing Long-Term Investment Outcomes

Vanguard's research reveals that its 200/175 threshold-based strategy surpasses conventional calendar-based rebalancing in multiple aspects. The reduced allocation drifts provide better risk control, and the lowered transaction costs lead to potentially higher long-term investment outcomes. A study examining a hypothetical 60% global equity/40% global fixed income portfolio showed significantly better results using the 200/175 approach over a ten-year period. The potential variance between rebalancing methods can be drastic, particularly in volatile market conditions.

The Certainty Fee Equivalent: Measuring the Value of the 200/175 Strategy

To quantify the superior performance of the 200/175 rebalancing method, Vanguard utilized a certainty fee equivalent. This metric represents the fee an investor would be willing to pay for the enhanced results offered by this approach compared to calendar-based methods. The study reveals a substantial annual advantage ranging from 5 to 21 bps for TDF investors. This seemingly small percentage point difference compounds significantly over time, producing a noteworthy improvement in an investor's overall portfolio performance.

Daily Monitoring: A Worthwhile Investment

While the implementation of the 200/175 rebalancing strategy requires daily monitoring, this additional oversight is well justified by the research findings. The potential enhancements to investment outcomes over the long term significantly outweigh the minor increase in administrative effort. The ability to keep portfolios closely aligned with their target risk profiles, while minimizing costly trades, is pivotal to achieving the best possible returns for TDF investors.

Securing Your Retirement: The Vanguard Advantage

Vanguard’s dedication to its investors is evident in its pursuit of innovative and effective strategies. The 200/175 threshold-based rebalancing approach demonstrates a commitment to optimizing TDF performance and enhancing long-term investment success. This strategy effectively balances cost management and risk control, offering a compelling advantage for those seeking a more efficient path to retirement security. Through continuous research and development, Vanguard continues to lead the way in providing investors with the tools they need to achieve their financial goals. By carefully managing costs and maintaining optimal risk exposure, Vanguard strives to help investors achieve a more successful and secure retirement. Remember that all investing has risks. Past performance is not indicative of future results.