Qualcomm Eyes Intel: A Deal That Could Shake Up the Tech Industry

Qualcomm, the leading chipmaker, has reportedly approached Intel about a potential takeover. The news sent shockwaves through the tech industry, raising questions about the implications of this potential deal.

Potential Impact of a Qualcomm-Intel Merger

The deal, if successful, would be one of the largest technology mergers in history, potentially reshaping the landscape of the chip industry. Intel, with a market cap of approximately $96 billion, has been struggling to keep up with its competitors in recent years. Qualcomm's move could be a strategic attempt to capitalize on Intel's struggles and expand its own market reach.

Impact on Intel

The takeover could be a lifeline for Intel, which has been grappling with declining profits and market share. Qualcomm's expertise in mobile chipsets could provide Intel with a much-needed boost in the growing mobile device market. The merger could also help Intel to better compete in the burgeoning artificial intelligence (AI) market, where Nvidia currently dominates.

Impact on Qualcomm

Qualcomm stands to gain significantly from a takeover of Intel. The merger would give Qualcomm access to Intel's vast manufacturing infrastructure and its established position in the PC and laptop market. Additionally, the deal could give Qualcomm a stronger foothold in the data center market, which is expected to grow significantly in the coming years.

Regulatory Challenges and Potential Roadblocks

While the potential benefits of a Qualcomm-Intel merger are significant, the deal faces substantial regulatory hurdles. Both companies are major players in the chip industry, and any merger would likely face intense scrutiny from antitrust regulators. In the past, similar deals have been blocked on national security grounds. For example, in 2017, Broadcom's attempt to acquire Qualcomm was blocked by the Trump administration due to concerns about Broadcom's Singaporean headquarters.

The Current Landscape of the Chip Industry

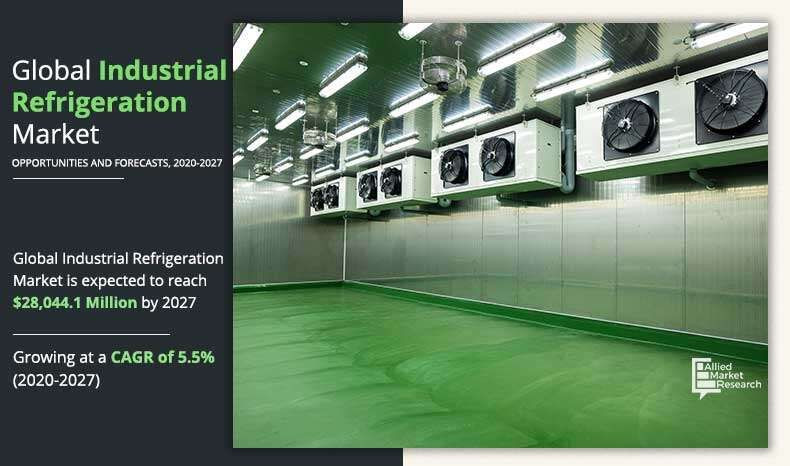

The semiconductor industry is facing a global shortage of chips, fueled by the rapid growth of the AI market and the increased demand for consumer electronics. This shortage has put pressure on chipmakers to increase production and expand their manufacturing capacity. The potential merger of Qualcomm and Intel could have significant implications for the industry, influencing pricing, supply chains, and technological innovation.

The Future of the Deal

It remains uncertain whether the deal will ultimately come to fruition. Both Qualcomm and Intel have declined to comment on the matter. However, the potential implications of the deal are far-reaching and are likely to be the subject of much speculation in the coming weeks and months.

What This Means for the Tech Industry

The reported Qualcomm-Intel merger is a testament to the shifting dynamics in the tech industry. The rapid advancements in AI and the increasing demand for mobile devices have created a fierce competition among chipmakers. The potential deal highlights the need for companies to consolidate their resources and adapt to the evolving landscape of the tech industry.

The Future of Chip Manufacturing

The deal could also have a significant impact on the future of chip manufacturing. Qualcomm's reliance on contract manufacturers like TSMC and Samsung could lead to changes in Intel's manufacturing strategy. The merger could also prompt other companies to consider mergers or acquisitions to remain competitive in the industry.

Qualcomm and Intel: A Timeline

2024:

- September 20: Qualcomm approaches Intel about a potential takeover, according to the Wall Street Journal. The news sends Intel's stock soaring.

- September 21: Intel confirms that it is reviewing strategic options, including potential partnerships and investments, in a memo to its employees. The company acknowledges the challenges it has faced in recent years, and its commitment to its foundry business, a project that could cost $100 billion over the next five years.

The Bottom Line

The potential merger of Qualcomm and Intel is a game-changer for the tech industry. If the deal goes through, it will have far-reaching implications for the future of chip manufacturing, the development of AI technology, and the competitive landscape of the industry. It's still too early to predict the outcome of the deal, but it's sure to be a story to watch closely in the coming months.