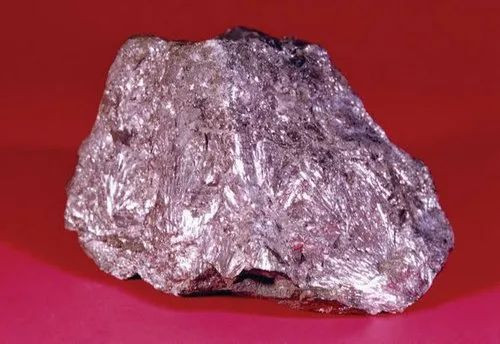

Antimony: The Unsung Hero of Modern Warfare and the 21st Century

More than 100 years ago, a ship carrying antimony sank to the bottom of the Atlantic. At the time, the metal was deemed unimportant, but today, it’s a critical component in modern military and industrial applications, highlighting its resurgence and soaring prices.

The Growing Threat of an Antimony Shortage

For decades, the U.S. has relied heavily on antimony imports from China, which controls nearly 50% of mining and 80% of global production. This dependence has created a precarious situation, especially with rising geopolitical tensions. The U.S. military, recognizing the risks, is actively seeking domestic sources. This shortage is further exacerbated by the increasing demand for antimony across various sectors, including the booming renewable energy market and the growing production of electronics.

The Pentagon's Scramble for Domestic Antimony

The Pentagon's concern over antimony supply is legitimate. American manufacturers use over 50 million pounds annually, underscoring the metal's critical role in producing semiconductors, batteries, and solar panels. Disruptions to the supply chain could severely impact national security and economic stability.

Military Metals Corp.: A Key Player in Securing Domestic Antimony Production

Military Metals Corp. (CSE:MILI; OTCQB:MILIF) is strategically positioned to capitalize on this growing demand. The company is revisiting the historic West Gore Antimony Project in Nova Scotia, a mine that once supplied antimony during both World Wars. This mine, coupled with the recent acquisition of one of Europe’s largest antimony deposits in Slovakia, positions Military Metals Corp as a significant player in the global antimony market. The Slovakian acquisition alone boasts a potential in situ value of $2 billion, based on current market prices and their 60,998 tons of historical antimony resource. This, coupled with their current market capitalization of just $23 million and healthy cash position, represents a tremendous opportunity for growth.

Comparing Military Metals Corp to Perpetua Resources

Perpetua Resources, currently receiving a $1.86 billion government loan for its strategic resource development, is valued at approximately $700 million with 90,000 tons of antimony. Military Metals Corp.'s potential in situ value and lower market cap illustrate its significant upside potential, making it an attractive investment opportunity.

The Strategic Importance of Domestic Antimony Production

The potential reopening of the West Gore mine is much more than a business venture; it's a critical strategic move to secure North America's access to this vital mineral, which is listed as a critical mineral by the U.S. government. China's control over global antimony production underscores the need for domestic sources to ensure national security and prevent reliance on potentially unreliable foreign suppliers. Military Metals Corp's projects are not only strategically important to the North American economy but offer investors a unique opportunity to participate in a potentially transformative business.

The Growing Private Sector Interest in Antimony

The rising demand from both government and private sectors is driving the increased focus on antimony production. The private sector's interest reflects the growing needs of various high-tech and renewable energy industries, which are rapidly increasing their usage of antimony. The scarcity of this essential mineral is rapidly accelerating the private sector investment in new projects, making Military Metals' strategy both timely and potentially highly profitable.

Antimony-Focused Strategy: A Global Powerhouse in the Making

Military Metals Corp.'s strategy centers on the acquisition and development of antimony resources globally. With their recent European acquisition announcement adding to their North American focus, they are establishing themselves as a global leader. This proactive approach showcases their commitment to meeting the increasing demand for this critical mineral and positions them to benefit significantly from the ongoing global shifts in geopolitical strategies.

The Future of Antimony

The global antimony market is projected for significant growth in the coming years. Military Metals Corp. is positioning itself not just as a beneficiary of this growth, but as a key player in shaping the future of antimony supply chains and potentially becoming one of the leading suppliers outside of China. Their strategy of securing projects both in North America and in Europe makes them a particularly resilient investment opportunity in this rapidly evolving global market. This aggressive pursuit of antimony assets demonstrates their commitment to becoming a major global player, mitigating risks associated with geopolitical instability and supply chain disruptions.

Five Reasons to Keep an Eye on Military Metals Corp.

- Control of the historic West Gore antimony mine, a crucial asset amidst restricted Chinese exports.

- Antimony's importance in both military hardware and civilian technologies like renewable energy and electronics.

- Mitigation of U.S. vulnerability to Chinese antimony dominance. The company is one of the few with domestic antimony projects.

- Alignment with government initiatives aimed at bolstering domestic critical mineral supplies.

- Strategic positioning to benefit from the growing global demand for antimony driven by high-tech sectors. This is amplified by the recent acquisition of one of the largest historical antimony deposits in Europe.

Final Thoughts for Investors: A High-Stakes Race

The world faces increasing geopolitical tensions and supply chain uncertainties, making the importance of securing critical minerals like antimony paramount. Military Metals Corp. is emerging as a significant player in this high-stakes game, showcasing a combination of strategic acquisition, historical knowledge and future-forward planning. The company is strategically positioned to benefit from the growing demand for domestic and European antimony, and this presents a compelling investment opportunity for those looking to capitalize on this crucial market shift. The future of modern warfare, renewable energy, and high-tech industries might well hinge on companies like Military Metals Corp. and their innovative approaches to securing this crucial resource. This is an industry worth watching closely.