Hybrid Fiber Coaxial Market: A Booming Industry Driven by Demand for High Bandwidth

The global hybrid fiber coaxial (HFC) market size was US$ 14.10 Bn in 2023 and is expected to reach US$ 24.20 Bn by 2030, at a CAGR of 8.02% during the forecast period. This growth is fueled by a number of factors, including the increasing demand for higher bandwidth, the cost efficiency associated with HFC cables, and the growing advancements in Internet of Things (IoT) technology.

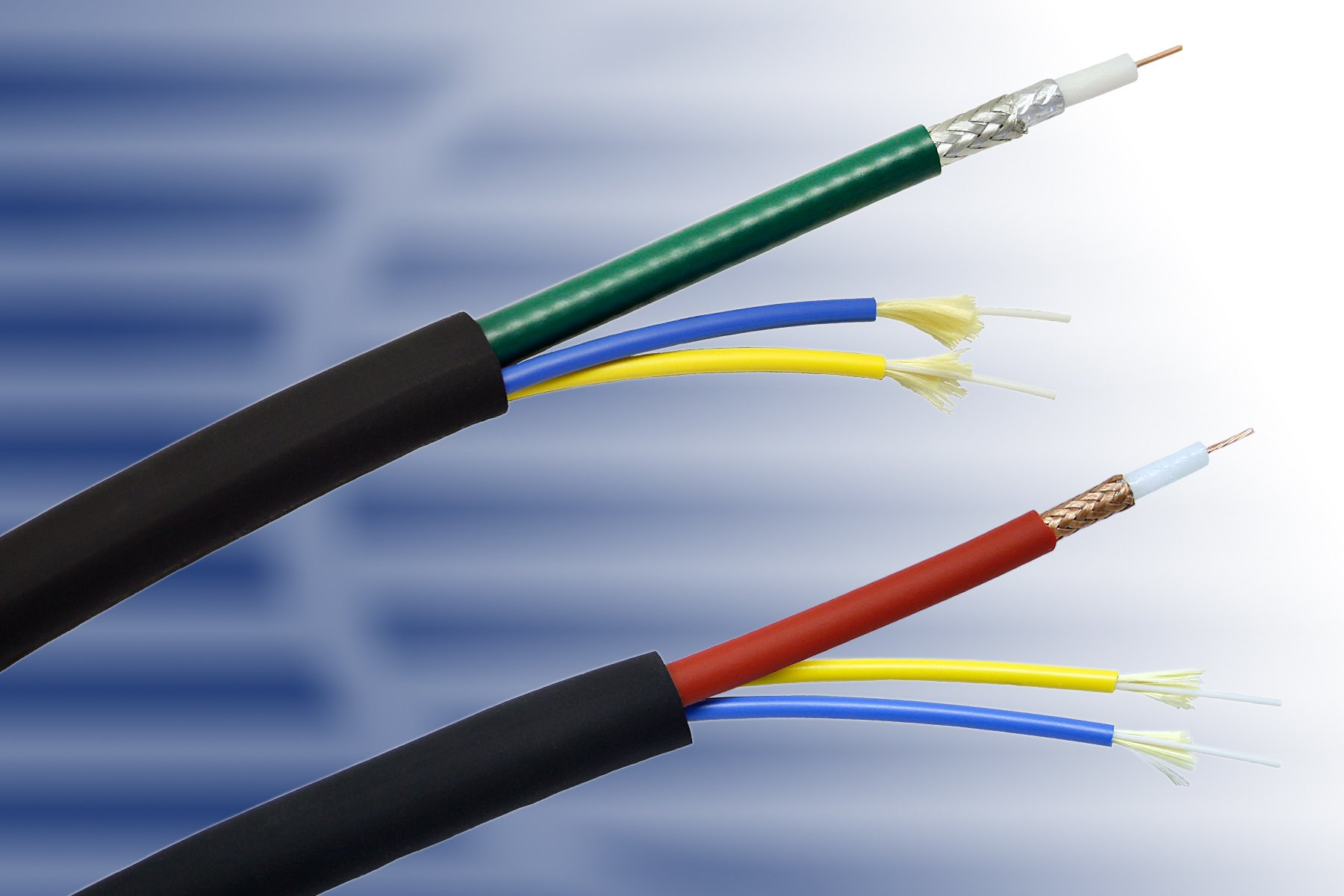

HFC technology is widely used in telecommunications and broadband networks. It provides a cost-effective way to deliver high-speed internet, digital television, and voice services to homes and businesses. HFC networks combine the high bandwidth capacity of fiber optic cables with the existing infrastructure of coaxial cables. This hybrid approach allows for a more efficient and affordable way to expand broadband access.

Market Dynamics: What's Driving Growth?

The growth of the telecommunication industry worldwide is a key driver of the HFC market. As the demand for faster and more reliable internet access increases, so too does the need for HFC technology. This is particularly true in developed countries where households and businesses are increasingly reliant on high-speed internet for work, entertainment, and communication.

Another factor driving market growth is the cost efficiency of HFC cables. These cables offer a more affordable alternative to fiber optic cables, which can be expensive to install and maintain. This is a major advantage for telecommunication providers who are looking for cost-effective ways to expand their broadband networks.

Regional Insights: North America Leads the Way

North America dominated the HFC market in 2023 and is expected to continue its dominance during the forecast period. The United States and Canada are the major contributors to the market's growth in this region. This is due in part to the strong demand for high-speed internet in these countries and the extensive deployment of HFC networks.

Segmentation: Understanding the Components and Technologies

The HFC market can be segmented by technology and by component. Here's a closer look at each:

By Technology

- DOCSIS 3.0 & Below: This technology provides data speeds of up to 160 Mbps downstream and 40 Mbps upstream. It is widely deployed in existing HFC networks.

- DOCSIS 3.1: This is the latest generation of HFC technology, offering significantly faster data speeds of up to 10 Gbps downstream and 1 Gbps upstream. It is being increasingly adopted by telecommunication providers to meet the growing demand for high-bandwidth services.

By Component

- CMTS/CCAP: These are the headend equipment that connects fiber optic cables to coaxial cables in HFC networks.

- Fiber Optic Cable: This type of cable provides the high bandwidth capacity of HFC networks.

- Amplifier: Amplifiers are used to boost the signal strength of the data transmitted through coaxial cables.

- Optical Node: Optical nodes connect the fiber optic cable to the coaxial cable network.

- Optical Transceiver: This device converts electrical signals into optical signals and vice versa.

- Splitter: A splitter divides the signal from the coaxial cable to multiple subscribers.

- CPE: CPE (Customer Premises Equipment) refers to the equipment that is installed at the subscriber's premises, such as cable modems and set-top boxes.

Key Players Shaping the Market

The HFC market is dominated by a few major players, including:

- Comcast: A leading cable provider in the United States, Comcast has invested heavily in expanding its HFC network.

- Charter Communications: Another major cable provider in the United States, Charter Communications is also a key player in the HFC market.

- Altice USA: This cable provider serves several major metropolitan areas in the United States.

- Cox Communications: Cox Communications is a large cable provider in the western United States.

- Rogers Communications: A Canadian cable provider, Rogers Communications has deployed HFC networks throughout Canada.

- Telus: Another major Canadian cable provider, Telus has invested heavily in HFC technology.

The Future of Hybrid Fiber Coaxial: A Look Ahead

The future of the HFC market looks bright. The demand for higher bandwidth and the increasing adoption of HFC technology in developing countries are expected to continue driving market growth in the coming years. Telecommunication providers are also investing in upgrading their existing HFC networks to support faster data speeds and new services. This will further fuel market growth. As HFC technology continues to evolve, it is likely to play an even greater role in delivering high-speed internet and other broadband services to homes and businesses around the world.

The HFC market is expected to be driven by the increasing demand for high bandwidth and the rising adoption of HFC technology in developing countries. Telecommunication providers are also investing in upgrading their existing HFC networks to support faster data speeds and new services. This will further fuel market growth. As HFC technology continues to evolve, it is likely to play an even greater role in delivering high-speed internet and other broadband services to homes and businesses around the world.

The growing demand for high-speed internet and the cost efficiency of HFC cables are expected to drive the growth of the HFC market in the future.