IRS opens 2025 tax season: Your Guide to Faster Tax Refunds

The 2025 tax filing season officially commenced on January 27th, with the Internal Revenue Service (IRS) beginning to accept and process 2024 individual income tax returns. Millions of returns are expected to flood the IRS systems, with over 140 million individual tax returns anticipated before the April 15th deadline. This year, the IRS anticipates that more than half of all tax returns will be filed with the assistance of a tax professional, emphasizing the need to choose trusted professionals to avoid potential scams.

Understanding Refund Timing

The IRS aims to issue most refunds in under 21 days for those who e-file and opt for direct deposit. However, several factors can influence refund processing times. Taxpayers should avoid relying on a specific refund date, especially when making significant purchases or paying bills. Returns requiring additional review can experience delays.

Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) Refunds

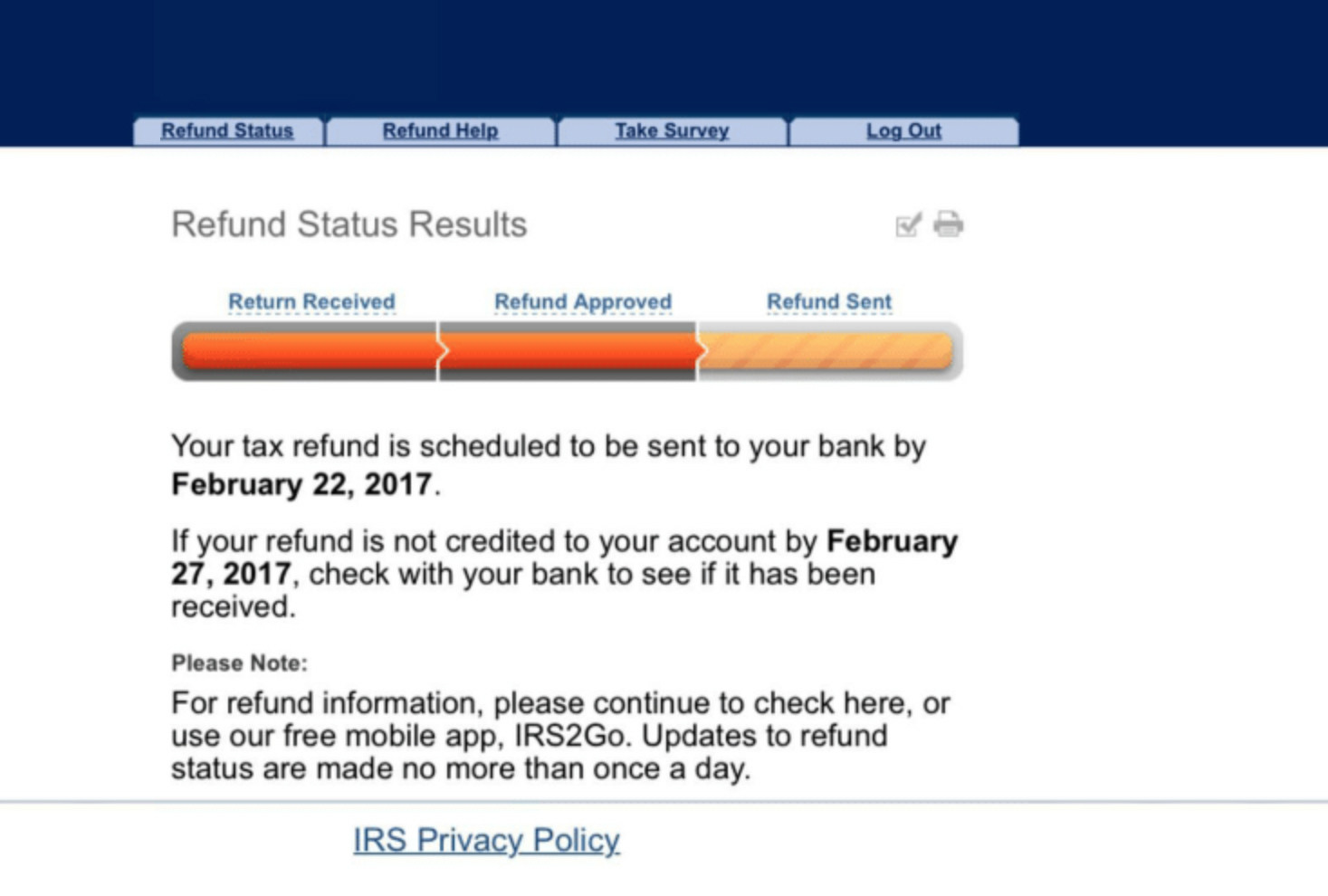

The Protecting Americans from Tax Hikes (PATH) Act mandates that the IRS cannot issue EITC and ACTC refunds before mid-February. The 'Where's My Refund?' tool on IRS.gov or the IRS2Go app should display an updated status by February 22nd for most early filers claiming these credits. Most EITC/ACTC refunds, if filed electronically and without complications, are expected in taxpayer accounts by March 3rd.

Avoiding Tax Scams and Protecting Your Identity

Tax season often sees a surge in scams targeting taxpayers. Individuals should be wary of attempts to obtain personal, financial, or employment information under false pretenses. Tax-related identity theft, where personal information is used to file fraudulent returns, poses a significant risk. Taxpayers who suspect identity theft should continue filing their returns, even if it requires a paper return. The IRS provides resources and consumer alerts to help taxpayers stay informed about the latest scams.

IRS Online Resources and Free Filing Options

The IRS website, IRS.gov, serves as a crucial resource for taxpayers. The Interactive Tax Assistant (ITA) offers personalized guidance on various tax-related queries. The IRS strongly encourages electronic filing and direct deposit for faster and more secure refunds, highlighting that paper checks are significantly more prone to issues.

IRS Free File and Direct File

For eligible taxpayers, the IRS offers free online and in-person tax preparation services. IRS Free File provides guided tax software for individuals with an income of $84,000 or less. Direct File, available in 25 states, allows taxpayers to file online directly with the IRS, offering guidance in both English and Spanish and integration with state tax systems. These digital options are crucial in today's digital age.

Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE)

VITA provides free tax help to those who generally make $67,000 or less, persons with disabilities, and non-English speakers. TCE offers free assistance, particularly for those 60 and older, specializing in pension and retirement-related matters. These free resources are particularly useful for the financial wellbeing of our nation.

MilTax

MilTax, a Department of Defense program, offers free tax preparation and electronic filing to military members and some veterans, regardless of income level.

Checking Your Refund Status and Addressing Delays

The easiest way to monitor your refund's status is through the 'Where's My Refund?' tool on IRS.gov or the IRS2Go app. While the IRS strives for timely processing, there may be unforeseen delays. E-filing and choosing direct deposit significantly expedite the process. Remember, the IRS cautions against relying on a specific refund date. Additional review may be needed for some returns, potentially increasing processing time.

2025 Filing Season Improvements

The IRS is continuously improving its services, enhancing features in the IRS Individual Online Account, introducing redesigned notices, and developing mobile-adaptive tax forms. The integration of voicebot services for refund information and the expansion of online chatbot support across multiple webpages further demonstrates the IRS's commitment to providing better taxpayer assistance. These improvements are pivotal to improving efficiency and user experience. They show the IRS's dedication to upgrading taxpayer service.

Preparing Your Return and Avoiding Delays

Accuracy and completeness are crucial for avoiding delays. Gather all necessary income and informational documents before filing. Ensure you have all W-2 forms, 1099 forms (including 1099-Ks for online marketplace payments), and other relevant documents. Double-checking details such as Social Security numbers for dependents is vital for a smooth process. Furthermore, filing your taxes in a timely fashion and avoiding last-minute submissions can significantly minimize the risk of errors and delays.

Choosing a Tax Preparer

More than half of taxpayers seek professional assistance. While the majority of tax preparers provide excellent services, selecting an unqualified preparer can lead to financial harm. The IRS offers guidance on choosing a reputable preparer, including checking for a valid Preparer Tax Identification Number (PTIN). It also offers an IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications to assist taxpayers in making an informed decision. Choosing a preparer affiliated with a recognized national tax association is a good option. Electronic filing providers authorized by the IRS can also be a trusted resource for preparing and e-filing returns, ensuring both accuracy and efficiency.

Additional Resources and Assistance

Taxpayer Assistance Centers (TACs) provide in-person help nationwide. Several free tax preparation programs assist those with low-to-moderate incomes. The Accounting Aid Society, Wayne Metropolitan Community Action Agency, and AARP Foundation Tax-Aide offer support to eligible individuals. Free File through IRS.gov is also an excellent option for many taxpayers.

Final Thoughts: Plan Ahead for a Smooth Tax Season

Filing taxes can be a complex and stressful process. Yet, a bit of preparation and awareness of the resources available can make the experience easier and less taxing. Whether you choose to file your own tax return or seek professional help, the knowledge and understanding of the available tools and resources from the IRS and various support agencies empower individuals to manage their tax responsibilities with confidence. By staying informed about tax scams and utilizing the free resources available, taxpayers are equipped to handle the process effectively and efficiently, paving the way for a smoother tax season. Remember that careful preparation and early filing, combined with a proactive approach to monitoring your refund status, can significantly reduce the stress and uncertainty often associated with tax season. Taxpayers should remain vigilant and take proactive steps to ensure their compliance and protect themselves from potential financial harm.