Westpac and its subsidiary banks have resolved issues related to its app and internet banking systems. The major bank was hit by an outage leaving thousands of customers unable to access their internet banking.

"Our online and mobile banking services have now been restored," Westpac said in a message to customers at 3:15pm on Monday. "We apologise for the disruption this afternoon and thank you for your patience during this time."

Westpac customers first started reporting issues on Monday afternoon at around 1pm, with Down Detector showing a spike of more than 6,000 outage reports. Hundreds more St George, BankSA and Bank of Melbourne customers also reported outages at the same time.

Outage Impact

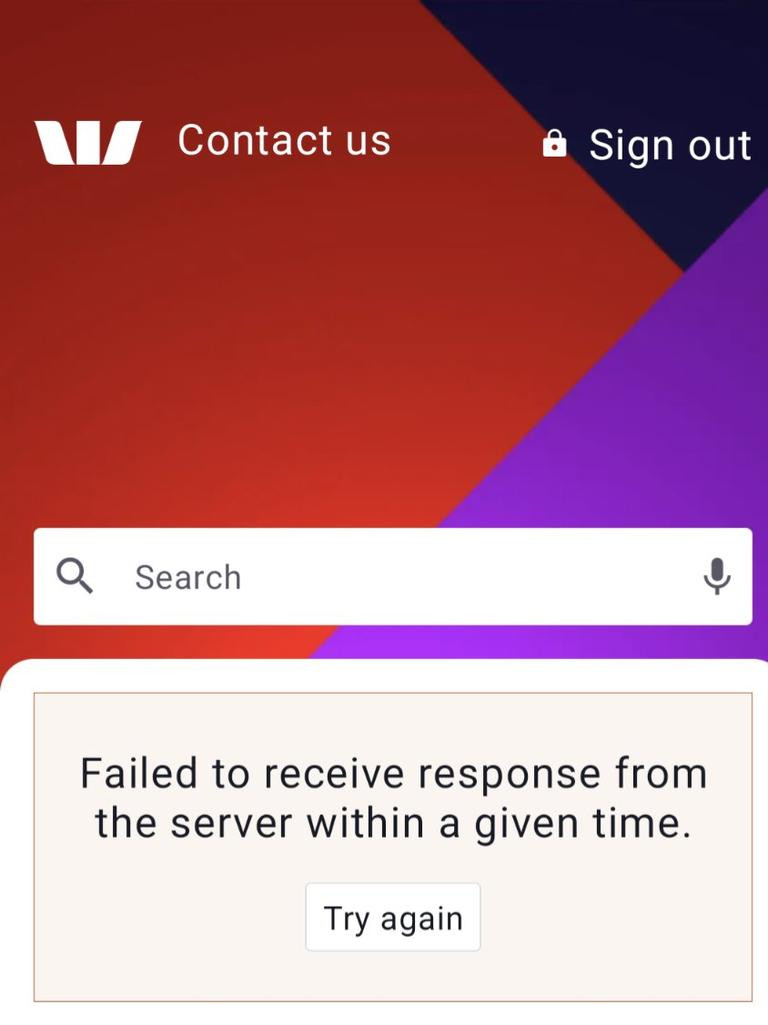

Customers trying to access internet banking were met with a message that confirmed there was a “service disruption” causing some customers to experience “intermittent issues”.

Westpac, along with its subsidiaries St George, BankSA and Bank of Melbourne, told customers it had been working to fix the outage as a "priority" and apologised for the inconvenience.

Hundreds of customers have taken to Westpac’s social media to complain about the outage, with many unable to make payments during the outage.

"Well I need it fixed NOW! trying to transfer money to pay for fuel!" one said.

"Got bills to pay, come on. How are we supposed to go all online when this happens," another added.

"Stopped me from getting Oasis tickets! Had the tickets reserved - went to my Westpac app to get my credit card details.... Something’s not working.... Something’s not working... Not happy," a third wrote.

Cashless Society Concerns

Others said the issue highlighted the challenges of Australia moving towards becoming a cashless society.

"This is ridiculous. Happens so many times and they want to go cashless. You’re joking!" one said.

The outage comes days after Westpac and its subsidiary banks removed cardless ATM withdrawals for customers. The change means customers now need to use their physical bank card to withdraw cash.

Westpac's Response

"Over a 12-month period, we’ve seen a 21 per cent increase in mobile wallet transactions as more customers choose the speed, security and convenience of digital banking. At the same time, there has been a decline in Cardless Cash withdrawals," the spokesperson said.

Digital Payments and Outage Concerns

While the convenience of digital payments is undeniable, incidents like this outage highlight the potential pitfalls of a cashless society. When major banking systems fail, it can leave individuals and businesses stranded, unable to access essential services. This raises concerns about the reliability and security of digital payment infrastructure. As Australia moves towards a more cashless society, it is crucial to ensure the resilience and security of these systems to minimize disruption and inconvenience for customers.

This outage serves as a stark reminder of the need for robust backup systems and contingency plans to mitigate the impact of such disruptions. As digital payment systems become increasingly prevalent, it is imperative that banks and financial institutions prioritize the reliability and security of their infrastructure to ensure the smooth functioning of the financial ecosystem.