The Nikkei 225 stock index plunged 12.4% on Monday, resuming sell-offs that are shaking world markets as investors fret over the state of the U.S. economy. The index closed down 4,451.28 points at 31,458.42, marking its worst single-day decline since 1987, with the market's broader TOPIX index falling 12.8% as selling picked up in the afternoon.

Darkening the outlook for trading on Wall Street, early Monday the future for the S&P 500 was 2.4% lower and that for the Dow Jones Industrial Average was down 2.6%.

A report showing hiring by U.S. employers slowed last month by much more than expected has convulsed financial markets, vanquishing the euphoria that had taken the Nikkei to all-times highs of over 42,000 in recent weeks. The Nikkei 225 dropped 5.8% on Friday, making this its worst two-day decline ever. Its worst single-day rout was a plunge of 3,836 points, or 14.9%, on Oct. 20, 1987, a day that was dubbed “Black Monday.” This Monday was gloomy enough: at one point, the benchmark sank as much as 13.4%.

Share prices have fallen in Tokyo since the Bank of Japan raised its benchmark interest rate on Wednesday. The Nikkei is now down 3.8% from a year ago.

One factor driving the BOJ to raise rates was prolonged weakness in the Japanese yen, which has pushed inflation to above the central bank's 2% inflation target. Early Monday, the dollar was trading at 142.59 yen, down from 146.45 late Friday and sharply below its level of over 160 yen a few weeks ago.

The euro fell to $1.0914 from $1.0923.

Shares surged to stratospheric heights earlier this year on frenzied buying of stock in companies expected to thrive thanks to advances in artificial intelligence. The latest setback has hit markets heavily weighted toward computer chipmakers like Samsung Electronics and other technology shares: on Monday, South Korea's Kospi plummeted more than 9% as Samsung's shares sank 11.6%. It closed 8.8% lower at 2,441.55.

Taiwan's Taiex also crumbled, losing 8.4% as Taiwan Semiconductor Manufacturing Co., the world's biggest chip maker, dropped 9.8%.

Stocks began tumbling in earnest on Friday after weaker than expected data on U.S. jobs fanned worries that high interest rates meant to tame inflation might push the U.S. economy into a recession.

“To put it mildly, the spike in volatility-of-volatility is a spectacle that underlines just how jittery markets have become,” Stephen Innes of SPI Asset Management said in a commentary. “The real question now looms: Can the typical market reflex to sell volatility or buy the market dip prevail over the deep-seated anxiety brought on by this sudden and sharp recession scare?”

The VIX, an index that measures how worried investors are about upcoming drops for the S&P 500, was up about 26% as of early Monday. Bitcoin which recently had surged to nearly $70,000, was down 14% at $54,155.00.

Oil prices slipped, with U.S. benchmark crude oil giving up 74 cents to $72.78 per barrel. Brent crude, the international standard, lost 67 cents to $76.14 per barrel.

Investors will be watching for data on the U.S. services sector from the U.S. Institute for Supply Management due later Monday that may help determine if the sell-offs around the world are an overreaction, Yeap Jun Rong of IG said in a report.

Even though worries over weakness in the U.S. economy and volatile markets have rippled around the world, the U.S. economy is still growing, and a recession is far from a certainty. But the mood was decidedly dark.

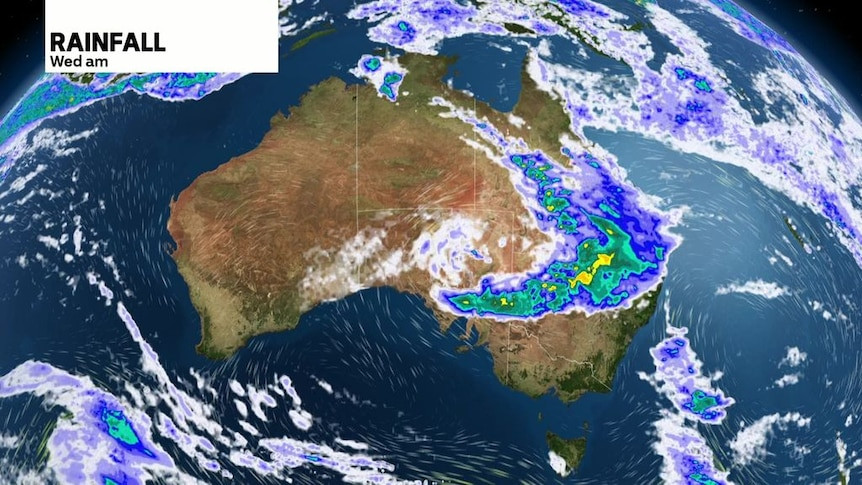

Hong Kong's Hang Seng index lost 2.2% to 16,579.97 and the S&P/ASX 200 in Australia declined 3.7% to 7,649.60.

The Shanghai Composite index, which is somewhat insulated by capital controls from other world markets, edged higher but then gave way, losing 1.5% to 2,862.56.

The S&P 500's 1.8% decline Friday was its first back-to-back loss of at least 1% since April. The Dow Jones Industrial Average dropped 1.5%, and the Nasdaq composite fell 2.4%, taking it to 10% below its record set last month. That level of drop is what traders call a “correction.”

The rout began just a couple days after U.S. stock indexes had jumped to their best day in months after Federal Reserve Chair Jerome Powell gave the clearest indication yet that inflation has slowed enough for cuts to rates to begin in September.

Now, worries are rising the Fed may have kept its main interest rate at a two-decade high for too long, raising risks of a recession in the world's largest economy. A rate cut would make it easier for U.S. households and companies to borrow money and boost the economy, but it could take months to a year for the full effects to filter through.

“Specifically, the scenario of higher unemployment constraining spending and further restraining hiring and incomes and economic activity leading to a recession is the feared scenario here,” Tan Boon Heng of Mizuho Bank in Singapore said in a report.